Executive Summary

VantagePoint represents a paradigm shift in technical analysis software, moving beyond traditional backward-looking indicators to provide forward-looking market predictions through artificial intelligence and intermarket analysis. Having analyzed multiple independent evaluations and test results spanning several years, this review synthesizes the key findings about this pioneering trading tool.

Over my decades-long career working with traders across every conceivable approach and evaluating countless trading systems and software platforms, I’ve been selective about where I invest my own development efforts. VantagePoint stands among the very few platforms I chose to build several of my most prized indicators in. This decision wasn’t made lightly—it reflects VantagePoint’s robust architecture, forward-looking methodology, and genuine edge in market analysis that aligns with the rigorous mathematical approach to trading I’ve championed throughout my career.

The proprietary indicators I developed for VantagePoint are designed for more advanced traders who have already mastered the platform’s foundational indicators. New users should focus first on understanding VantagePoint’s core predictive tools—the Predicted Neural Index, Predicted Moving Averages, and other primary indicators—before exploring the advanced mathematical concepts embedded in my specialized indicators.

My path to VantagePoint has an interesting history. In 1987, I had the privilege of working with Larry Williams during his legendary trading championship performance, where he transformed $10,000 into over $1 million in a single year—one of the most remarkable trading achievements ever documented. Years later, in 2010, Larry made the decision to build some of his best and most private indicators into VantagePoint. When I later considered where to develop my own proprietary indicators, Larry’s recommendation carried tremendous weight. He told me VantagePoint was a solid tool and that the Mendelsohns were good people—high praise from someone of Larry’s caliber and experience. A few years after Larry’s integration, I followed his lead and built my own indicators into the platform, a decision I’ve never regretted.

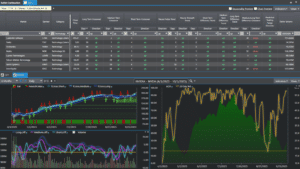

Chart 1: Additional proprietary Vantagepoint predictive indicators with customizable views tailored to individual trader preferences and strategies.

The Core Innovation: Predictive vs. Reactive Analysis

Traditional technical analysis tools excel at showing what has happened – VantagePoint’s breakthrough lies in forecasting what will happen. The software employs patented neural network technology to analyze relationships between global markets, identifying the 30 most influential markets affecting any target market you’re tracking.

This intermarket approach recognizes a fundamental truth about modern markets: no asset trades in isolation. When crude oil moves, it affects currencies, transportation stocks, and commodities. When central banks adjust policies, ripples spread across forex, bonds, and equities globally. VantagePoint quantifies these relationships mathematically, creating what the software calls a “weight matrix” that captures each market’s influence.

Chart 2: Intermarket relationships analysis (patented process) showing correlated markets that influence Broadcom including semiconductor stocks, Forex, financials, technology, healthcare, leveraged ETFs, bonds, commodities, and other AI-identified impactful markets.

Accuracy Analysis: The Numbers Behind the Claims

Independent testing across various time periods and market conditions has consistently validated VantagePoint’s accuracy claims. Cross-asset verification demonstrates consistent performance across stocks, crypto currencies, forex, and ETFs.

The software’s flagship Predicted Neural Index compares today’s actual three-day moving average with a predicted three-day moving average, forecasting whether typical price will be higher or lower two days ahead. This binary signal – green for up, red for down – provides clear, unambiguous guidance.

Chart 3: Predicted moving averages with verified support/resistance levels, Larry Williams’ Electronic Market Accumulation indicator, Neural Index strength, and predicted short/medium/long-term differences indicating trend direction and momentum, plus additional Ralph Vince and Larry Williams proprietary indicators.

Independent Academic Validation: The Arcuri Study

One of the most rigorous examinations of VantagePoint’s performance came from Dr. Phillip Arcuri (Ph.D., Oxford 1985), who conducted an independent analysis in May 2023. This wasn’t a marketing piece—it was a serious academic study analyzing real performance data from August 10, 2021 to August 15, 2022, encompassing 137,605 crossover events across 2,403 securities.

Dr. Arcuri’s methodology was exemplary. Rather than simply reporting raw accuracy numbers, he compared VantagePoint’s predictions against “naïve models”—the standard technical indicators that most traders use in platforms and other programs doing technical analysis. This comparison was designed to determine a baseline accuracy rate and the assess if there was any positive impact of utilizing Artificial Intelligence the way VantagePoint deploys it in their patent process. He even included standard deviations, confidence intervals, and tested across multiple market sectors including stocks, forex, cryptocurrencies, and ETFs. The study evaluated 15,000 neural networks trained on over 10 million data points.

The findings were compelling: VantagePoint’s Neural Index predicted market direction correctly 76.13% of the time, compared to 64.24% for simple baseline models—an increase of 11.89 percentage points which can be translated to an increase of almost 20% in performance accuracy. When traders applied proper filtering techniques, success rates reached 73.65% versus 62.68% for standard systems. Some securities showed even more impressive results, with Avient reaching 84.65% accuracy.

What makes these numbers meaningful isn’t just their magnitude—it’s their consistency and statistical significance. The study demonstrated that VantagePoint’s predictions showed reduced lag and fewer transient false signals compared to traditional moving averages, precisely the weaknesses that doom most technical trading systems. Performance remained relatively stable across different market sectors, suggesting the underlying AI methodology is robust rather than optimized for specific conditions.

From my perspective, having spent decades studying position sizing and optimal f, I can tell you that even modest improvements in directional accuracy compound dramatically over time when combined with proper money management. An 11.89 percentage point edge isn’t just statistically significant—it’s the difference between long-term profitability and slow capital erosion. This is why VantagePoint earned my confidence as a platform worthy of housing my proprietary indicators.

Key Predictive Indicators

Predicted Moving Averages

Unlike traditional moving averages that lag price action, VantagePoint’s predicted averages often turn a few days before actual averages, providing early trend change signals. The software optimizes combinations for short, medium, and long-term timeframes.

Predicted Trading Range

The software forecasts next day’s high and low, valuable for traders looking to optimize their entries, set more effective stops, and identify breakout levels.

Predicted Differences

These indicators measure momentum shifts by tracking convergence and divergence between different timeframe predictive moving averages, highlighting when trends are strengthening or weakening days in advance.

Traditional Indicators Made Predictive

RSI, MACD, Stochastics, and other popular indicators are transformed into forward-looking tools using VantagePoint’s AI engine.

Chart 4: Vantagepoint predictive moving averages with proprietary and predicted Ichimoku cloud indicator, patented Neural Index showing trend direction and strength, and predictive random walk index for advanced traders.

Chart 4: Vantagepoint predictive moving averages with proprietary and predicted Ichimoku cloud indicator, patented Neural Index showing trend direction and strength, and predictive random walk index for advanced traders.

Market Coverage and Accessibility

VantagePoint now covers an extensive universe of tradeable assets:

Over 2,000 symbols across global markets, US Stocks across 16 sectors including Energy, Transportation, Financial, Healthcare, and Technology, comprehensive forex coverage including major pairs and cross-rates, extensive ETF selection across 19 sectors including U.S., International, Short & Ultrashort, Currency, Commodity, Leveraged, AI & Robotics, and Bitcoin/Cryptocurrency ETFs, and over 30 Cryptocurrency markets and coins including Bitcoin, Ethereum, and Litecoin.

The software operates on end-of-day data, making it ideal for swing traders and position traders who don’t require real-time feeds. Setup is remarkably straightforward – the interface is intuitive enough that users can navigate markets and generate forecasts within minutes of installation.

Practical Application: The IntelliScan Feature

One of VantagePoint’s most powerful features is IntelliScan, which filters thousands of markets in seconds using over 70 customizable criteria. Rather than manually reviewing charts, traders can instantly identify markets showing specific patterns like:

Recent Predictive moving average crossovers, positive Predictive Neural Index readings, aligned short, medium, and long-term trend forecasts, and momentum acceleration patterns based on Predictive data.

This filtering capability transforms an overwhelming universe of opportunities into a focused list of high-probability setups.

Chart 5: Vantagepoint’s trademarked Intelliscan feature – drag-and-drop scanning technology that analyzes thousands of instruments in seconds to identify best trading opportunities based on custom criteria, with easy drill-down capabilities for deeper analysis.

Chart 5: Vantagepoint’s trademarked Intelliscan feature – drag-and-drop scanning technology that analyzes thousands of instruments in seconds to identify best trading opportunities based on custom criteria, with easy drill-down capabilities for deeper analysis.

Historical Context and Evolution: Three Decades of Proven Performance

Louis Mendelsohn didn’t just create VantagePoint – he pioneered the entire field of AI-powered trading software. In the late 1980s, when most traders were still plotting charts by hand and artificial intelligence was largely confined to academic research labs, Mendelsohn was already applying neural network technology to financial market forecasting. His groundbreaking work culminated in VantagePoint’s commercial release in 1991, making it the first AI-based trading software available to individual traders.

This historical perspective matters profoundly in today’s AI landscape. While countless companies now rush to slap “AI-powered” labels on hastily assembled tools, VantagePoint represents over three decades of continuous refinement, testing, and validation in real market conditions. It’s not an experiment, a beta product, or a trendy add-on feature – it’s a mature, battle-tested platform that has navigated through multiple market cycles, crashes, bull runs, and structural shifts in how global markets operate.

Mendelsohn’s prescient insight in the 1980s was recognizing that markets were becoming fundamentally interconnected through globalization. While his contemporaries focused on perfecting single-market technical analysis, he understood that the future belonged to intermarket analysis. His innovation wasn’t just technical – it was conceptual, shifting focus from isolated market analysis to understanding the complex web of global market relationships.

The software has evolved through multiple generations since that 1991 debut, with each version incorporating decades of accumulated market data and retraining neural networks on recent market behavior. This continuous learning process ensures the AI adapts to changing market dynamics, from the dot-com bubble through the 2008 financial crisis, the rise of high-frequency trading, the pandemic volatility, and today’s AI-driven algorithmic environment.

Why Longevity Matters in AI Trading Tools

VantagePoint’s 30+ year track record provides something no new AI trading tool can offer: proof of adaptability and sustained accuracy across radically different market regimes. Many trading systems that work brilliantly in one type of market fail catastrophically when conditions change. VantagePoint has demonstrated consistent performance through:

VantagePoint has demonstrated consistent performance through the 1990s bull market and dot-com boom, the 2000-2002 bear market and tech crash, the 2008 financial crisis and its aftermath, the quantitative easing era’s unprecedented monetary policy, the flash crash events and high-frequency trading proliferation, the COVID-19 market disruption and subsequent recovery, and today’s environment of geopolitical uncertainty and AI-driven trading.

This isn’t a new AI toy being field-tested on live trader accounts. It’s a thoroughly proven system with three decades of real-world results, thousands of satisfied users, and a founder who literally wrote the book on computerized trading (Mendelsohn has authored multiple published works on trading technology and intermarket analysis).

The distinction between VantagePoint and today’s wave of “AI trading” startups is stark. While new entrants train their algorithms on limited historical data and hope for the best, VantagePoint’s neural networks have been refined through actual market experience spanning multiple generations of technology and trading environments. The system you use today benefits from 30+ years of pattern recognition across billions of data points and countless market scenarios.

Limitations and Considerations

VantagePoint is not a “black box” system generating automatic buy/sell signals. It provides predictive intelligence that traders must interpret and act upon. Success still requires:

- Sound money management

- Appropriate position sizing

- Understanding of market context

- Discipline to follow the indicators

The software works with end-of-day data, making it less suitable for day trading strategies requiring intraday signals. Additionally, while the accuracy rates are impressive, the 13-20% of incorrect predictions remind us that no system is infallible.

Value Proposition

At approximately $2,900 to start, VantagePoint represents a significant investment for individual traders. However, considering its accuracy rates and comprehensive market coverage, the software can potentially pay for itself quickly through improved trade selection and timing. The company offers free demonstrations and maintains strong customer support, including installation assistance and ongoing training.

Conclusion

VantagePoint stands apart in the crowded field of technical analysis software by doing something genuinely different – using artificial intelligence to forecast market movements rather than simply analyzing historical patterns. The consistent accuracy demonstrated across multiple independent tests, combined with its comprehensive market coverage and user-friendly interface, makes it a powerful tool for serious traders.

While it won’t make trading decisions for you, VantagePoint provides the kind of forward-looking intelligence that was previously available only to institutional traders with teams of analysts and powerful computing resources. For traders seeking an edge in increasingly complex global markets, VantagePoint offers a sophisticated yet accessible solution that has proven its worth over three decades of market evolution.

The software particularly suits swing traders and position traders who value accuracy over speed, and who understand that successful trading requires both powerful tools and disciplined execution. In an era where markets move on algorithms and global interconnections, VantagePoint provides individual traders with AI-powered insights that level the playing field.

About the Author:

Ralph Vince is a renowned quantitative analyst, professional trader, and pioneer in portfolio mathematics and money management. He is widely recognized for his groundbreaking work on optimal position sizing and risk management strategies in trading and investing. Vince has authored several influential books including The Mathematics of Money Management (1992), which introduced traders to the concept of optimal f (the Kelly Criterion applied to trading), and Portfolio Management Formulas (1990). His research focuses on the mathematical optimization of trading systems, particularly how to determine optimal capital allocation to maximize geometric growth while managing risk. His contributions have significantly influenced modern quantitative trading and risk management practices, making complex mathematical concepts accessible and applicable to traders seeking to optimize their portfolio performance.