Options trading is an essential part of many investors’ strategies, and Robinhood has become a popular platform for executing options trades. One common question traders have is whether Robinhood automatically exercises options upon expiration. In this detailed guide, we will explore how Robinhood handles options expiration, automatic exercise rules, and what traders need to know to manage their positions effectively.

Options Expiration on Robinhood

When an option contract reaches its expiration date, traders must decide whether to exercise, sell, or let the contract expire worthless. If no action is taken, Robinhood follows specific rules for automatic exercise. Understanding these rules can help traders avoid unwanted outcomes and maximize their investment strategies.

Robinhood’s Automatic Exercise Rules

Robinhood follows standard industry practices regarding options expiration and automatic exercise. Here’s how it works:

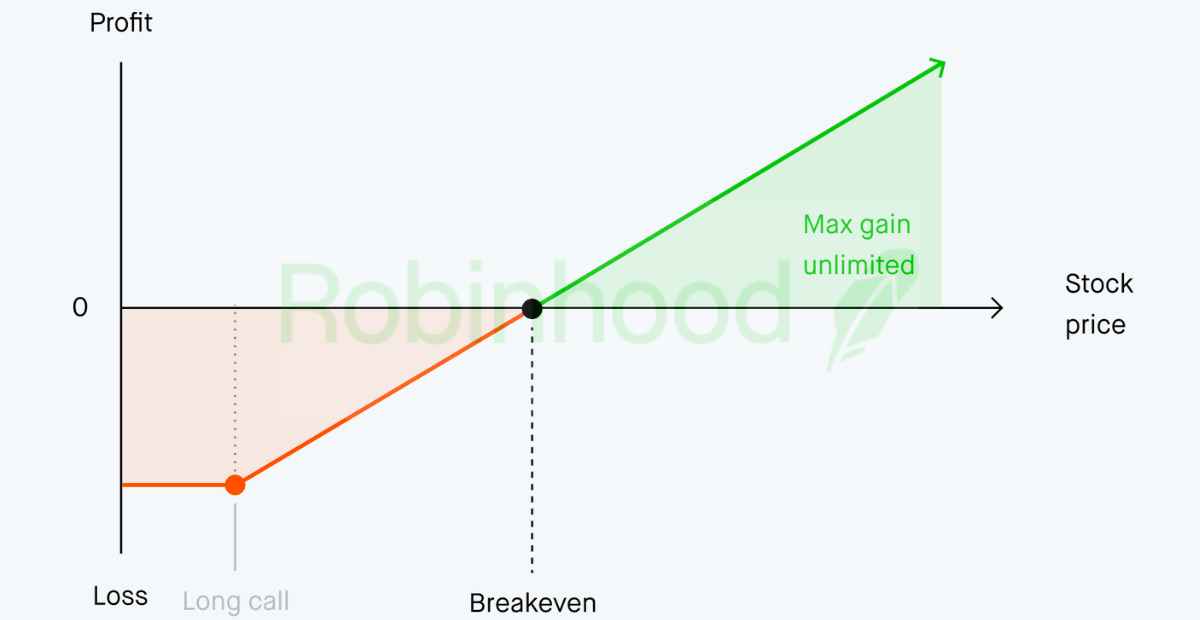

1. In-the-Money (ITM) Options

- If an option contract is in the money (ITM) by at least $0.01 at expiration, Robinhood automatically exercises the option on behalf of the trader.

- For call options, this means buying the underlying stock at the strike price.

- For put options, this means selling the underlying stock at the strike price.

- Automatic exercise only occurs if the account has sufficient buying power or shares to meet the obligations.

2. Out-of-the-Money (OTM) Options

- If an option contract is out of the money (OTM) at expiration, Robinhood does not exercise it.

- The contract expires worthless, and the trader loses the entire premium paid for the option.

3. Near-the-Money Options

- If an option is close to the strike price but slightly in the money, traders should monitor their positions closely to avoid unexpected auto-exercise.

- Traders can manually close the position before expiration if they do not wish to exercise the contract.

What Happens if You Don’t Have Enough Buying Power?

Robinhood will only exercise an option if the trader’s account has enough funds or margin availability. If there are insufficient funds to cover the cost of exercising, one of the following may occur:

- The contract will not be exercised, and Robinhood may allow it to expire worthless.

- Robinhood may automatically liquidate other assets in the account to cover the exercise cost.

- If neither option is feasible, the trader may face account restrictions or forced liquidation.

How to Avoid Unwanted Automatic Exercise

To prevent unintended auto-exercise, traders should consider the following strategies:

1. Close the Position Before Expiration

- If you do not want your option to be exercised, you can sell the contract before market close on the expiration date.

- This helps avoid assignment risks and allows you to capture any remaining value in the option.

2. Monitor Your Buying Power

- Ensure that your account has sufficient funds to handle auto-exercise.

- If you are low on funds, consider closing the position to avoid unwanted margin calls.

3. Use Robinhood’s Early Exercise Feature

- Robinhood allows traders to manually exercise options early if they prefer.

- This can be useful for capturing profits before expiration or avoiding last-minute market fluctuations.

What Happens if You Are Assigned a Stock?

If your option is exercised, you will either:

- Receive shares of the stock if it is a call option.

- Sell shares of the stock if it is a put option.

If you do not have enough funds or shares to meet the assignment obligation, Robinhood may automatically liquidate positions to cover the requirement.

Expiration Day Trading Strategies

For active traders, knowing how to handle options on expiration day is crucial. Here are some strategies:

1. Rolling Options

- If you want to avoid expiration but still maintain exposure, you can roll your option to a later expiration date.

- This involves selling your current contract and buying a new one with a later expiry.

2. Cash-Secured Puts & Covered Calls

- Using cash-secured puts or covered calls can help reduce risk if you intend to hold shares after expiration.

3. Monitoring Market Movements

- On expiration day, stock prices can fluctuate rapidly.

- Always check the bid-ask spread and market trends before making final decisions.

Conclusion

Robinhood does automatically exercise in-the-money options at expiration if the trader’s account has sufficient funds. However, out-of-the-money options expire worthless. Traders must monitor their positions, manage their buying power, and close contracts in advance if they wish to avoid automatic execution.