Generating consistent cash from the stock market has always appealed to me, but most strategies either pay out small amounts or simply don’t work.

That’s where Tim Plaehn comes in. His approach claims to produce meaningful monthly income from large companies even though they don’t typically pay out dividends.

Is Plaehn onto something, or will I be adding this to my pile of lackluster approaches?

In this ETF Income Maximizer review, I investigate whether the strategy truly delivers dependable income or comes up short.

>> Try ETF Income Maximizer Now<<

What is ETF Maximizer?

ETF Income Maximizer is an income-focused research service created by Tim Plaehn and published through Investors Alley.

Its core goal is simple: help its readers generate wealth from exchange-traded funds (ETFs) instead of more traditional methods like stocks or bonds.

There’s nothing flashy about it, but that’s exactly why I like it so much.

Having safer ways to generate consistent income for retirement or even a big purchase is a win in my book any day.

Subscribers receive Plaehn’s guidance through a streamlined newsletter format, along with supporting tools that reflect his years of research.

The service is built to be practical, repeatable, and easy to follow, which helps explain why it’s drawing attention from people looking for steady income without complexity.

>> Join Now for Tim’s Best Strategy <<

What is Investors Alley?

Investors Alley is an independent financial research publisher that has been operating since the late 1990s, making it one of the earlier players in the modern newsletter industry.  Long before online investment commentary became crowded, the firm carved out a niche by focusing on actionable strategies rather than broad market commentary.

Long before online investment commentary became crowded, the firm carved out a niche by focusing on actionable strategies rather than broad market commentary.

Over the years, Investors Alley has built a lineup of premium research services that cover income, options, and market trends, with an emphasis on clarity and execution.

I often turn to the publisher for structured insights through its recurring newsletters and market updates to help staygrounded in changing economic conditions.

Editors like Tim Plaehn and Jay Soloff apply their experience directly through these services, offering detailed analysis and clearly defined recommendations.

That combination of longevity, specialization, and practical research has helped Investors Alley maintain relevance while many newer publishers struggle to establish trust.

>> Get ETF Income Maximizer for $49 Only <<

Who Is Tim Plaehn?

Tim Plaehn’s path into income-focused research started well before financial publishing.

He served in the U.S. Air Force as a fighter pilot, learning patience and persistence before graduating from the Air Force Academy with a degree in mathematics.

After leaving the military, Plaehn spent years as a stock broker and Certified Financial Planner where he saw value in dividends and the power of income.

All that hands-on experience shaped how he thinks about cash flow, sustainability, and risk.

Over time, he transitioned into financial research, deliberately focusing on income strategies while avoiding more risky methods.

Today, he applies that practical background as an editor at Investors Alley, where his work centers on building disciplined income systems designed to hold up across different market environments.

Is Tim Plaehn Legit?

In my opinion, Tim Plaehn has earned his credibility through consistency, depth of research, and a long-standing focus on income strategies.

He has spent more than a decade publishing research centered on dividends, ETFs, and cash-flow-driven portfolios, producing a plethora of content on the multiple services he contributes to.

Tim doesn’t just look good on paper, either. He often speaks at live conferences such as the MoneyShow, so you know he can back up what he preaches.

With more than 30 years as an income investor under his belt, you’d better believe that I’ll turn to him for insight and recommendations from this niche.

Tim Plaehn Net Worth

Tim Plaehn does not publicly disclose his net worth, and there is no verified figure available from official sources.

Based on his long career spanning military service, corporate leadership, financial publishing, book authorship, and years as a senior editor at Investors Alley, it wouldn’t surprise me in the least if he had a few million tucked away.

More telling than a dollar amount though is Plaehn’s consistent, income-first approach, which suggests his personal finances are built around discipline, sustainability, and long-term cash flow rather than speculation.

>> Access Tim Plaehn’s Best Stock Picks NOW <<

Who is Jay Soloff?

Jay Soloff brings a very different, yet complementary, skill set to ETF Income Maximizer.

He is a seasoned market professional with more than twenty years of experience rooted in derivatives and options markets.

Early in his career, Soloff worked directly on the trading floor at the Kansas City Board of Trade, where he traded wheat futures and developed a practical understanding of how price movement and volatility drive opportunity.

He later moved to the Chicago Board Options Exchange, gaining firsthand exposure to options mechanics, risk control, and income generation.

Beyond trading, Soloff has built a reputation as an educator and financial writer.

Today, as a Chief Income Officer at Investors Alley, he concentrates on blending income-focused strategies with disciplined entry points, adding a tactical layer that strengthens the overall service.

>> Get Jay Soloff’s Income Strategies Here! <<

What Is the ETF Income Maximizer Presentation?

If there’s one certainty in life, it’s the need to pay bills.

They arrive every month, yet most income strategies don’t match that rhythm.

They arrive every month, yet most income strategies don’t match that rhythm.

Dividends are paid quarterly, savings accounts barely keep pace with inflation, and many of the strongest stocks in the market offer no income at all.

The very thought of it feels like financial freedom will forever be out of reach as an ever-widening gap opens in front of me.

Tim hints that this gap exists because most of us rely on outdated income tools, while a newer structure has been quietly gaining traction that we should be looking into.

Why Traditional Income Keeps Falling Short

Plaehn spends time explaining why classic income approaches struggle in today’s environment.

Dividend yields on large companies often sit well below one percent, which does little to offset rising living costs.

Bonds move with interest rates, and relying on quarterly payouts creates timing problems when expenses are monthly.

As I alluded to before, even a solid dividend portfolio can feel ineffective unless a large amount of capital is committed. Inflation only compounds the issue, steadily eroding purchasing power.

This part of the presentation resonates with me because it focuses on real-world cash flow pressure, not long-term charts that ignore the day-to-day reality we all face.

>> Don’t Miss The Chance, ACT NOW! <<

Setting Aside the Old for the New

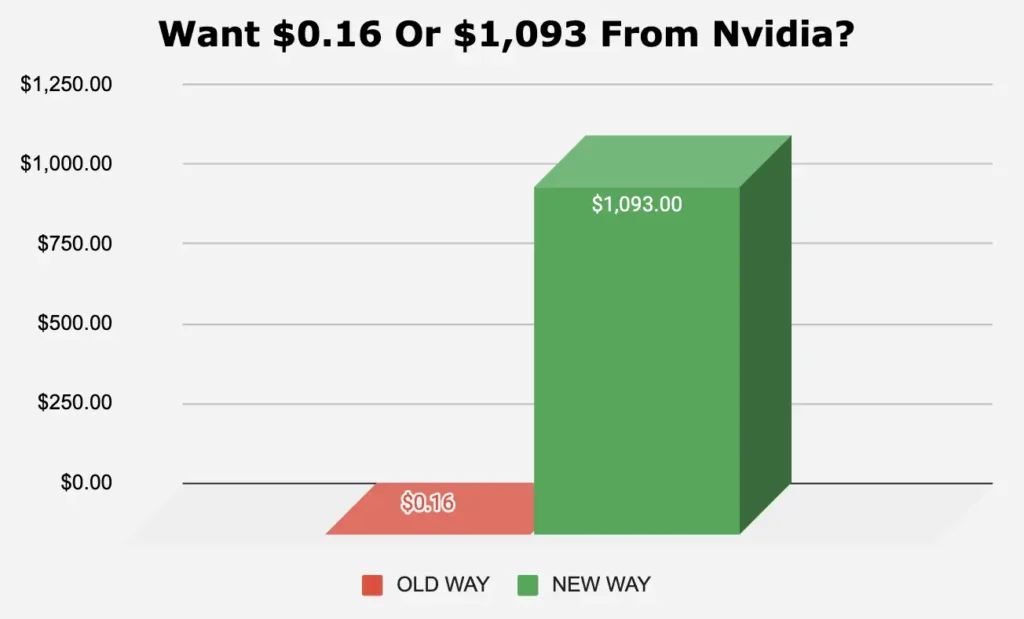

Here’s where the dots start to connect for me. Plaehn explains that income doesn’t have to come directly from company dividends.

Certain exchange-traded funds are structured to generate income using options tied to individual stocks, then distribute that income on a monthly basis.

He highlights examples connected to familiar names like Apple, Tesla, Amazon, and Coinbase, stocks that either pay very small dividends or none at all.

He highlights examples connected to familiar names like Apple, Tesla, Amazon, and Coinbase, stocks that either pay very small dividends or none at all.

Through these ETFs, the same stocks have produced sizable monthly distributions, including yields that far exceed traditional payouts.

What stood out to me is the simplicity. You’re not trading options or managing positions yourself.

The ETFs handle the mechanics internally, making the process feel as straightforward as owning a regular stock.

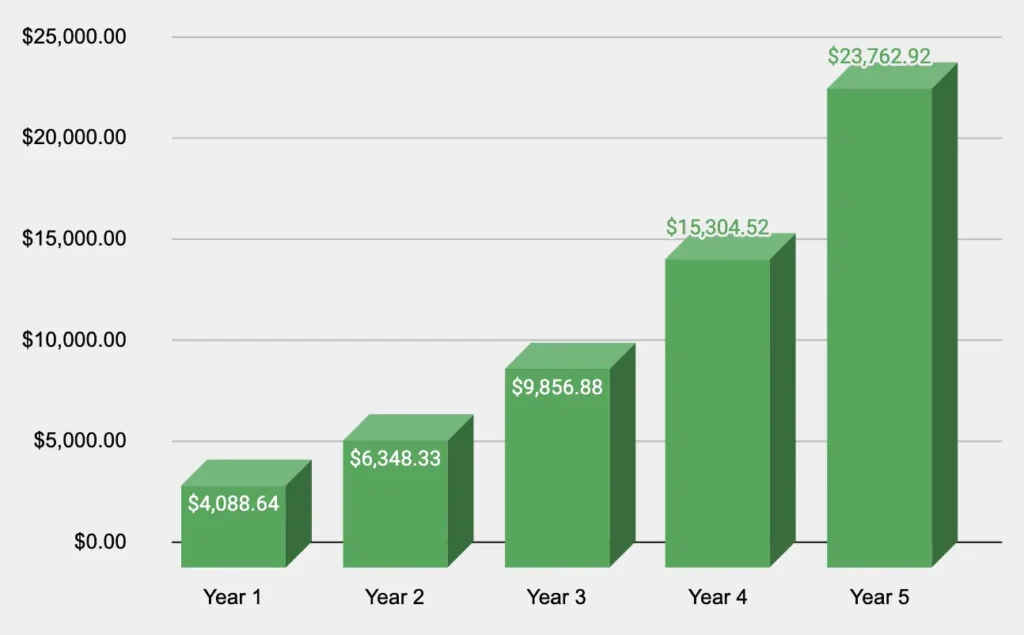

How Much You Can Earn Over Time

If you’re not familiar with some of these terms or mechanics, don’t let Tim’s strategy scare you.

If you’re not familiar with some of these terms or mechanics, don’t let Tim’s strategy scare you.

He’s very beginner-friendly in his approach, even though there’s plenty of meat here for anyone to chew on.

Even modest starting amounts, combined with steady contributions, can grow into meaningful monthly cash flow over a few years.

Of course, you need to know where to start, and that’s where Tim’s research comes in.

Anyone serious about building monthly cash flow can learn the specifics by joining the ETF Income Maximizer, which naturally leads into what’s included inside the service.

>> Get Jay’s Top Stock Picks Here <<

ETF Income Maximizer Review: What Comes With the Deal?

There’s a lot more than just ETF options plays inside ETF Income Maximizer, so let’s unpack it all now.

Annual Subscription to ETF Income Maximizer

An annual subscription gives continuous access to Tim Plaehn and Jay Soloff’s income research throughout the year.

This is super important because the strategy relies on monitoring ETF structures and income behavior over time, not on isolated picks.

I receive regular updates that explain how current holdings are performing, what to expect from upcoming distributions, and whether I should make any adjustments.

The guidance focuses on income sustainability rather than short-term yield spikes, which helps set realistic expectations.

Having year-round access ensures you are not left guessing as market conditions change or as individual ETF payouts fluctuate from month to month.

>> Unlock Monthly ETF Income Now <<

NEW ETF of the Month

The ETF of the Month is one of the central components of the service.

Whenever Plaehn and his crew introduce a new ETF, he walks through why it fits the income framework and how it complements existing positions.

These selections are based on the ETF is structured, its underlying stock exposure, and its ability to generate monthly distributions.

Rather than pushing constant activity, the service explains where each ETF fits within the broader income plan so you’re not left guessing.

This helps us understand when to add exposure, when to hold steady, and how new ideas support consistent cash flow instead of disrupting it.

A Member’s Only Portal

A Member’s Only Portal

All research, updates, and guidance are conveniently located within a private member portal.

This central hub keeps everything organized in one place, including current income positions, past updates, and educational explanations tied to the strategy.

I appreciate how clear and easy to navigate the layout is making it so much easier for me to focus on my investments.

Plus, being able to revisit prior commentary and portfolio guidance helps reinforce how the strategy works over time.

Dedicated Customer Support

Dedicated Customer Support

Dedicated customer support is included to help you with account access, billing questions, and navigation of the service.

While support does not provide personalized financial guidance, it ensures you can consistently access updates and materials without interruption.

That reliability matters when timing and continuity are important.

A responsive support team helps remove friction from the experience, allowing members to focus on following the strategy rather than dealing with technical or administrative issues.

>> Get ETF Income Maximizer at 92% Off <<

ETF Income Maximizer Bonuses

Beyond the core service, ETF Income Maximizer includes two bonuses designed to deepen your understanding of the strategy and give you additional tools to evaluate income opportunities more efficiently.

Bonus #1: Shortcut To Big Monthly Income With Single-Stock ETFs Report

This report serves as the backbone of the entire income concept.

In Shortcut To Big Monthly Income With Single-Stock ETFs, Tim Plaehn breaks down how single-stock ETFs work, why they exist, and how they are able to generate monthly income from stocks that traditionally pay little or nothing in dividends.

Tim explains everything in plain language, making this an excellent read even if you’re hearing about ETFs for the first time here.

It also clarifies the risks, trade-offs, and expectations that come with high-yield monthly payouts.

More importantly, it helps explain what separates a sustainable income ETF from one that looks attractive on the surface but may not hold up over time.

>> Freeze Your Bonus Access TODAY! <<

Bonus #2: Free Access to Magnifi AI

Free access to Magnifi AI adds a powerful research layer to ETF Income Maximizer.

This platform allows members to explore ETFs, stocks, and portfolios using simple questions rather than complicated filters or spreadsheets.  You can look up individual funds in depth, review their recent performance, inflows, turnover, and compare them directly with peers to see how they stack up on yield, volatility, fees, and risk.

You can look up individual funds in depth, review their recent performance, inflows, turnover, and compare them directly with peers to see how they stack up on yield, volatility, fees, and risk.

What makes Magnifi especially valuable is that it includes advisor-level tools like Morningstar Ratings and FI 360, resources normally reserved for professional money managers.

You can also evaluate your entire portfolio at once, instantly seeing how it’s projected to perform versus the market and where your biggest risk exposures sit.

Refund Policy

ETF Income Maximizer comes with an unusually generous 365-day money-back guarantee. That gives you a full year to review the research, follow the strategy, and see how the monthly income approach fits your situation.

That gives you a full year to review the research, follow the strategy, and see how the monthly income approach fits your situation.

During that time, you can access all updates, tools, and guidance without restriction.

If at any point within those 12 months you decide the service isn’t right for you, you can request a full refund under Investors Alley’s stated terms.

Guarantees like this are exceedingly rare and show how much confidence Plaehn places in his service.

Pros & Cons

Here are some of the most notable pros and cons of the ETF Income Maximizer research service.

Pros

- Monthly income focus

- A new ETF every month

- No options trading required

- Simple ETF-based structure

- Clear guidance and education

- Model portfolio included

- Led by an income-focused analyst

- Free Access to Magnifi AI

- 365-day Refund Policy

Cons

- No community chat/forum

- Offers little for short-term traders

>> Try 365-Days Risk-Free Guarantee Now <<

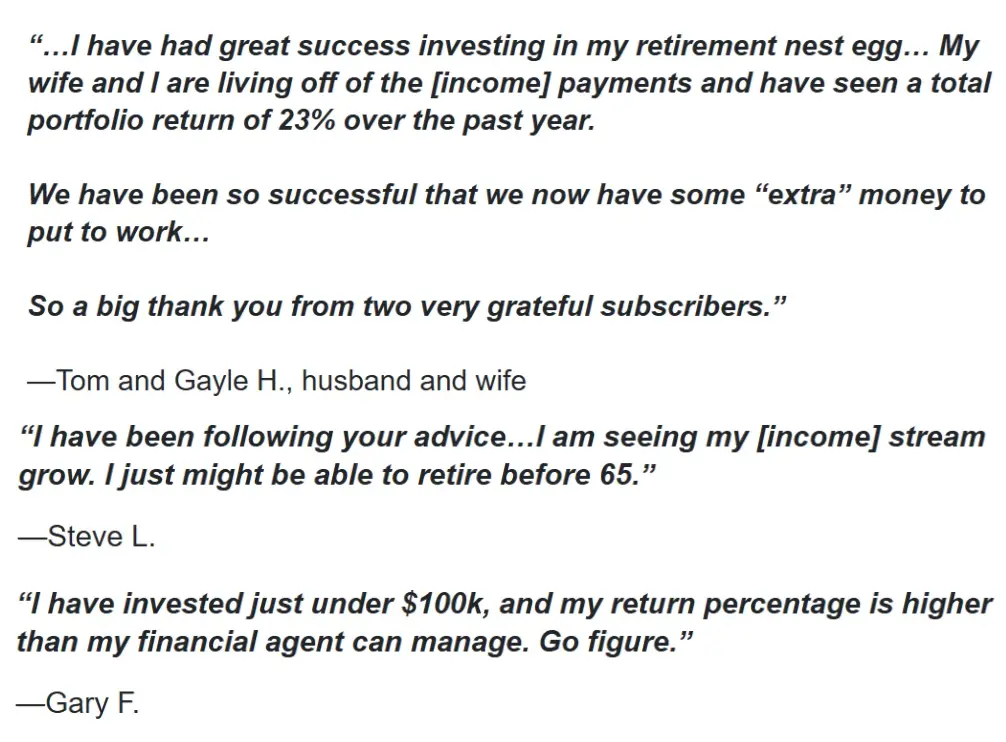

ETF Income Maximizer Reviews by Members

One thing that stood out while reviewing ETF Income Maximizer is how consistently subscribers talk about income growth rather than short-term wins.

Several members describe using the strategy to support retirement income, cover living expenses, or put idle capital to work more effectively than before. The review about the possibility of retiring before 65 was like a gut punch to me. We all deserve to have a clear path to retirement, and these reviews indicate ETF Income Maximizer is a worthwhile option.

The review about the possibility of retiring before 65 was like a gut punch to me. We all deserve to have a clear path to retirement, and these reviews indicate ETF Income Maximizer is a worthwhile option.

I pulled these from the promo, so take them with a grain of salt, but outcomes like this are very exciting for me.

>> Save 92% If You Join Right Now <<

ETF Income Maximizer Track Record and Past Performance

The promo shares some real-world examples of how the service works, and the results are promising.

These include annualized yields cited as high as 27.36% on Apple-linked ETFs, 36.78% on Amazon, 51.15% on Tesla, and as much as 140.07% on Coinbase-related structures.

While these figures fluctuate and are not guaranteed, they illustrate the income potential of the ETF structures the service focuses on.

Investors Alley also notes a broader base of more than 230,000 subscribers using income-oriented strategies across its services.

As always, results vary, but the data presented shows a consistent emphasis on monthly cash flow rather than speculative gains.

Who ETF Income Maximizer Is Best For

ETF Income Maximizer is especially well-suited for people who are starting to think seriously about income, whether that’s in preparation for retirement or simply to create more breathing room in their monthly budget.

The strategy is built around generating regular cash flow rather than chasing market highs, which naturally appeals to those who value consistency.

Anyone looking to supplement income can benefit, even if they’re approaching the idea without preconceived notions about traditional investing.

While some familiarity with ETFs and basic risk concepts helps, it’s not required.

Tim Plaehn and Jay Soloff spend time explaining the mechanics and expectations so members can follow along without feeling overwhelmed.

>> Start Monthly Income With Tim Plaehn <<

Risks and Downsides to Consider

Like any strategy tied to the stock market, ETF Income Maximizer carries risk. You should never view it as a guaranteed income source.  Monthly payouts can fluctuate, and market conditions can impact both income levels and ETF prices.

Monthly payouts can fluctuate, and market conditions can impact both income levels and ETF prices.

While the approach aims for consistency, results will vary depending on timing, allocation, and broader market behavior.

Another consideration is that the service prioritizes income generation over total return.

In some cases, ETF share prices may decline even while distributions continue, which means income needs to be weighed against overall portfolio value.

Finally, I’ve occasionally seen newer or less-established ETFs thrown in here.

These can offer attractive income potential, but may come with added uncertainty.

>> Join Tim Plaehn’s ETF Income Maximizer <<

ETF Income Maximizer Cost / Subscription Details

At the time of writing, ETF Income Maximizer is offered at a heavily discounted introductory rate for new members.

The standard option is an annual subscription priced at $49 for the first year, which is significantly lower than the regular rate disclosed during the checkout process.

After the initial term, the subscription renews at $99 per year, unless you cancel beforehand.

Given the ongoing research, monthly updates, and included tools, that renewal price is positioned as the long-term cost of maintaining access to the strategy.

During signup, you can add five years to your plan for just $297 if you’re totally gung-ho about what Tim’s doing here.

>> Get a full year of access for only $49! <<

Final Verdict: Is ETF Income Maximizer Worth It?

After going through everything, ETF Income Maximizer has a lot going for it if income is at least part of your game.

Tim takes the monthly grind into consideration, finding ways to generate enough income to keep up with bills and other expenses that can ultimately point us to financial freedom.

It’s the first service I’ve seen to go this extra mile, and if the math maths, could set you up nicely for retirement.

Keep in mind you’re getting an entire year of ETF suggestions and content to back these opportunities up.

Considering the low entry price, long refund window, and practical guidance, the service offers solid value for anyone focused on monthly income rather than speculation.

>> Claim Your Exclusive 92% Discount HERE <<

Noah Zelvis is an accomplished writer bringing over 18 years of professional experience to the table. His writing career took off by detailing his global travels in a personal blog, where his talent for crafting clear and concise content quickly led to paid opportunities. Leveraging an engineering background and an analytical mindset, Noah possesses a deep passion for business and finance. His interest in investing was sparked early in life while assisting his grandmother with her portfolio, fostering a lifelong quest for identifying top-performing stocks. He has also conducted extensive research into the corporate financial world and holds an acute understanding of the banking and credit sector. Beyond finance, his published works span diverse topics including travel, running, video games, and product reviews. At Stock Dork, Noah applies his extensive knowledge to share valuable financial and investment insights. Outside of work, you can find Noah indulging his passions for travel and running.