Sorting through stocks has become harder as markets fill with noise, opinions, and bold forecasts.

However, the crew at Alpha Picks by Seeking Alpha believes there’s a clear path through the chaos.

Instead of leaning on personality-driven commentary, this stock research service relies on a repeatable system designed to identify high-quality stocks and support disciplined portfolio construction.

In this Alpha Picks review, I take a close look at whether this Seeking Alpha service can really deliver consistent results without getting lost in short-term market chatter.

What Is Alpha Picks by Seeking Alpha?

Alpha Picks by Seeking Alpha is a relatively new stock research service designed to take a systematic approach to finding long-term opportunities in the market.  It centers around one key question I find myself asking all the time: which stocks show the strongest overall signals when you strip away headlines and opinions?

It centers around one key question I find myself asking all the time: which stocks show the strongest overall signals when you strip away headlines and opinions?

The answer comes in a live, actively managed portfolio supported by two new stock recommendations each month.

I appreciate that these picks go through the gauntlet before ever making the list. Each one must rank highly across several key measures, including fundamentals, valuation, growth trends, profitability, momentum, and forward-looking earnings estimates.

I think you’ll really like the structure too. Alpha Picks reduces guesswork by offering clear inclusions, ongoing monitoring, and updates when conditions change.

>> Optimize Your Stock Portfolio Right Now! <<

What Is Seeking Alpha?

Seeking Alpha is a comprehensive stock research platform built to help people make informed decisions using data, analysis, and real-time information.  Rather than going down the traditional newsletter route that so many others follow, it acts as a central research hub where users can evaluate companies from multiple angles in one place.

Rather than going down the traditional newsletter route that so many others follow, it acts as a central research hub where users can evaluate companies from multiple angles in one place.

The platform brings together quantitative ratings, detailed financial metrics, earnings call transcripts, market news, and long-form analysis from experienced contributors.

While there’s a ton of content here, the setup allows for either quick checks or deeper research, depending on how hands-on you want to be.

Plus, portfolio tracking tools and alerts help keep everything organized without requiring constant screen time.

In many ways, there’s something here for everyone. I’ll explain that a little more when we look at features in just a bit.

>> Join Alpha Picks By Seeking Alpha <<

Is Seeking Alpha Legit?

Yes, Seeking Alpha has earned its stripes through time-tested, battle-hardened data and research.

The platform has been operating for more than two decades and is used by millions of people each month to research stocks, track portfolios, and follow earnings in real time.  You just don’t get to that level in this industry unless you actually have the tools to deliver consistent value.

You just don’t get to that level in this industry unless you actually have the tools to deliver consistent value.

There’s also a level of transparency here I rarely see in a service, let alone one of this caliber.

Its Quant Ratings are rules-based, continuously updated, and openly explained, which shows why a stock’s outlook changes instead of expecting us to take ratings on faith.

I’ve also fallen in love with the earnings call transcripts and financial data that institutions rely on for their analysis.

Just as important, Seeking Alpha operates independently.

It doesn’t manage money or push brokerage products, which helps keep analysis objective.

>> Try Seeking Alpha’s Market Insights TODAY! <<

How Does Alpha Picks Work?

Alpha Picks operates as a rules-based stock selection system built on the research infrastructure of Seeking Alpha.  The process begins by continuously scanning thousands of U.S.-listed stocks using a quantitative model designed to measure overall business strength.

The process begins by continuously scanning thousands of U.S.-listed stocks using a quantitative model designed to measure overall business strength.

This data-driven approach really speaks to me. I really dislike making moves based on hype that honestly don’t pan out most of the time.

None of this is surface-level, either. Alpha picks evaluates companies across multiple dimensions, including valuation, financial health, growth trends, profitability, price behavior, and changes in earnings expectations.

Only stocks that score well across several of these areas move forward. From there, the Alpha Picks team reviews the candidates to ensure the data aligns with real-world business fundamentals.

This extra layer helps filter out names that may look good on paper but carry hidden risks.

Once selected, stocks are added to a transparent portfolio that members can track over time.

New ideas are introduced on a steady schedule, while existing holdings remain under constant review.

>> Get Alpha Picks Stock Picks Today <<

The Team Behind Alpha Picks

Alpha Picks is not run by a single personality. It’s managed by a dedicated quantitative research team within Seeking Alpha.

Steven Cress

Steven Cress is widely recognized as one of the key minds behind Seeking Alpha’s quantitative framework and the lead strategist for Alpha Picks.  He brings more than three decades of experience in equity research, portfolio strategy, and quantitative modeling.

He brings more than three decades of experience in equity research, portfolio strategy, and quantitative modeling.

Cress has been in the trenches for much of that time, working a trading desk at Morgan Stanley and founding two quant-based firms.

Seeking Alpha swept in and acquired his most recent research firm, choosing to bring the guru along with the purchase.

To me, that speaks volumes about how his work emphasizes the repeatability and risk control that Seeking Alpha is known for.

Cress is also a frequent contributor on the Seeking Alpha platform, where his written research and data-driven insights reach a wide audience.

That long history of applied research and system design gives Alpha Picks a level of depth that goes beyond surface-level stock selection.

>> Follow Steven Cress’s Alpha Picks System <<

Joel Hancock

Joel Hancock is a senior member of the research team supporting Alpha Picks and brings a strong analytical background to the service. Entering the picture with a BA in accounting, Hancock spent time at big names like Morgan Stanley, Goldman Sachs, and E*TRADE.

Entering the picture with a BA in accounting, Hancock spent time at big names like Morgan Stanley, Goldman Sachs, and E*TRADE.

His experience centers on equity research, financial modeling, and evaluating companies through a multi-factor lens.

As a data junkie like me, Joel has spent years working with large datasets, helping translate raw financial information into actionable insights.

I’ve seen him all over Seeking Alpha, contributing to research initiatives that focus on wide-angle views from earnings trends, valuation shifts, and long-term performance drivers.

From where I’m sitting, Hancock’s role complements the quantitative foundation of Alpha Picks by adding careful review and context to the data.

>> Unlock Alpha Picks Proven Stock System <<

Alpha Picks Review: What Comes with It?

Alpha Picks keeps things focused by offering a small set of features that all work toward finding great stocks without the complexity:

Two Stock Picks Every Month

Alpha Picks delivers two new stock recommendations each month on a consistent schedule, giving ample time to assess each idea. Its Quant system tracks these down from more data than any one of us would know what to do with, offering a clear edge.

Its Quant system tracks these down from more data than any one of us would know what to do with, offering a clear edge.

These selections can come from any niche, unlike other services I’ve seen that limit focus to a particular sector.

They enter as strong buys and only stay on the list for as long as they score well in areas like fundamentals or momentum.

I’ve noticed that’s usually a long runway, since the platform focuses most on gradual returns.

With the impressive track record they deliver, I’d say the method works.

>> Grab Two Top-rated Stock Alerts Monthly <<

Ratings Alerts

Alpha Picks includes a built-in alert system designed to connect you with the portfolio without requiring constant monitoring.

Whenever the system releases its new picks, you get a notification to review the additions and feel out if they fit with your own strategy.

Alerts also come into play on the downside. When a stock’s Quant Rating weakens materially, the system flags it.

Positions come off the list when a rating drops into clear sell territory, signaling that the data no longer supports holding the stock.

In some cases, a stock may also disappear if its rating stalls at a neutral level for an extended period or if a corporate action like a merger changes the original thesis.

>> Stay Updated With Real-time Ratings Here <<

Over 20 Alpha Picks Stock Recommendations

When you join Alpha Picks, you don’t start from zero.

New members get immediate access to the full active portfolio, which typically holds 20 or more stock recommendations at any given time.

This portfolio reflects every pick that still meets the system’s standards, giving you a broad view of how the strategy is deployed across the market.

The selections are not confined to a single sector or theme.

Instead, they naturally spread across industries based on where the strongest data appears at the time.

That dynamic mix helps reduce concentration risk and keeps the portfolio aligned with real market leadership.

My favorite part is that each stock features a written analysis explaining why it remains in the portfolio.

>> View Top Alpha Stock Picks Now! <<

What Should I Expect from Alpha Picks?

Alpha Picks is built with one clear objective in mind: outperforming the broader market over time by following a disciplined, portfolio-level strategy.  That doesn’t mean every stock added will be a winner. Some positions will inevitably lag or move sideways, and that’s expected.

That doesn’t mean every stock added will be a winner. Some positions will inevitably lag or move sideways, and that’s expected.

The key is how the portfolio evolves as a whole.

Stocks are monitored continuously, and positions are adjusted or removed when the underlying data no longer supports holding them.

This is not a quick-turn approach. Alpha Picks is designed to be followed patiently, with results measured across the full set of recommendations rather than individual picks in isolation.

You may also notice periods where several holdings cluster in the same industry. That usually reflects where the strongest signals exist at that moment, not a thematic bet.

Overall, you should expect a structured, long-term process that prioritizes consistency and discipline over short bursts of excitement.

>> Try Alpha Picks Research From Seeking Alpha <<

What is Alpha Picks’ Performance Track Record?

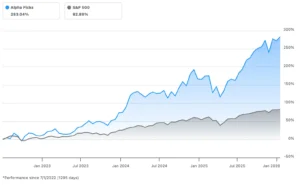

Alpha Picks has compiled a clearly documented track record since launching in July 2022, and the numbers are one of the strongest arguments in its favor.

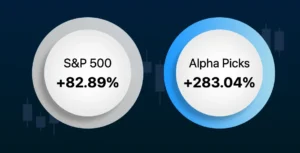

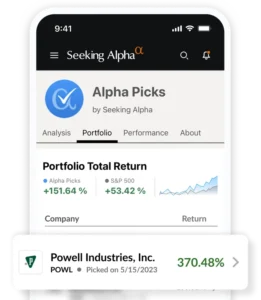

According to Seeking Alpha’s own published performance data, the Alpha Picks portfolio rise 280% to the S&P 500’s 83%.

According to Seeking Alpha’s own published performance data, the Alpha Picks portfolio rise 280% to the S&P 500’s 83%.

This is real data, not some hypothetical backtest that I’ve seen other services do.

Because results remain transparent, you can see how these numbers update in real time, along with what holding patterns for each pick along the way.

The strategy is designed so that a relatively small number of outsized winners can meaningfully lift overall performance, even when some picks underperform.

>> Sign Up For Alpha Picks Today! <<

Is Alpha Picks Right for Me?

Alpha Picks makes the most sense if you want help narrowing the market down without doing hours of screening on your own.

The service takes complex quantitative data and turns it into a small number of actionable ideas each month, which can be appealing whether you’re still building confidence or already comfortable analyzing stocks.

Instead of chasing leads across dozens of sources, you get a focused stream of research backed by a consistent framework.

Another point in its favor is clarity. Portfolio changes are communicated as they happen, so you’re not left guessing when a position no longer fits the strategy.

That structure can be especially helpful if decision fatigue or second-guessing has held you back in the past.

It’s also worth setting expectations. Alpha Picks is geared toward patient, long-term participation rather than frequent buying and selling.

If you’re comfortable letting data guide decisions and giving ideas time to play out, Alpha Picks is likely a good fit.

>> Explore Alpha Picks Right HERE! <<

How Much Does Alpha Picks Cost?

Alpha Picks by Seeking Alpha is priced as a premium stock research service, but the structure is straightforward.

A standard annual subscription comes in at $499 per year, which covers full access to the Alpha Picks portfolio, new monthly recommendations, and ongoing alerts.

From time to time, discounts are available that lower the upfront cost, often bringing the annual price closer to the mid-$400 range, depending on the promotion.

When you break that down, the cost works out to roughly $40 per month, which helps put the pricing into perspective.

For me, the appeal lies in the leverage. You’re paying for a system designed to narrow thousands of stocks down to a manageable set of ideas, backed by data and continuous monitoring.

>> Sign Up Now To Save an Extra 10% <<

Frequently Asked Questions

How Often Does Alpha Picks Release New Recommendations?

Alpha Picks releases two new stock picks every month, along with alerts when ratings change.

How Long Should I Hold Alpha Picks Recommendations?

Most picks are intended to be held for the long term. Holdings remain active as long as their data profile stays strong.

Is Alpha Picks Suitable for Retirement Accounts?

Yes, the long-term, buy-and-hold nature of Alpha Picks makes it suitable for retirement accounts, depending on individual risk tolerance.

Is Alpha Picks Worth It?

After spending time reviewing how the service operates and how its results are tracked, this Alpha Picks review left me with a clear takeaway.  For me, Alpha Picks stands out the most for clear, actionable picks framed by terabytes of data.

For me, Alpha Picks stands out the most for clear, actionable picks framed by terabytes of data.

Instead of sorting through endless research or conflicting opinions, the service narrows the market to a manageable set of ideas using a consistent, rules-based process.

The pacing also works in its favor. Two new picks per month keep things moving without creating pressure to constantly trade.

I also appreciate that the guidance extends beyond the initial buy, with ongoing ratings and alerts that help remove emotion from sell decisions.

That kind of structure can prevent costly mistakes over time.

When you weigh the pricing against the depth of research, transparency, and performance history, the value clearly stands out.

>> Upgrade With Alpha Picks By Seeking Alpha <<

Noah Zelvis is an accomplished writer bringing over 18 years of professional experience to the table. His writing career took off by detailing his global travels in a personal blog, where his talent for crafting clear and concise content quickly led to paid opportunities. Leveraging an engineering background and an analytical mindset, Noah possesses a deep passion for business and finance. His interest in investing was sparked early in life while assisting his grandmother with her portfolio, fostering a lifelong quest for identifying top-performing stocks. He has also conducted extensive research into the corporate financial world and holds an acute understanding of the banking and credit sector. Beyond finance, his published works span diverse topics including travel, running, video games, and product reviews. At Stock Dork, Noah applies his extensive knowledge to share valuable financial and investment insights. Outside of work, you can find Noah indulging his passions for travel and running.