Investors often debate how equity markets track performance. Two key methods—capitalization weighted and fundamental weighted—shape index construction. These approaches determine which stocks influence an index’s value most. For example, the S&P 500 uses capitalization weighting, while the FTSE RAFI index relies on fundamentals like sales and earnings.

Choosing between these strategies matters. Capitalization weighting boosts exposure to larger companies, reflecting market trends. Fundamental weighting focuses on business metrics, aiming to balance risks. Both methods affect portfolio diversification and returns, making this comparison critical for informed investing.

Key Takeaways

- Index construction methods define how stocks are weighted in equity markets.

- Capitalization weighting prioritizes company size, while fundamental weighting uses financial metrics.

- Each approach impacts risk, returns, and long-term investment outcomes.

- Popular indices like S&P 500 and FTSE RAFI exemplify these contrasting strategies.

- Investors must evaluate goals to decide which method aligns with their strategy.

Understanding Capitalization Weighted Indices

Capitalization-weighted indices are designed to mirror the performance of the broader stock market index. Their structure prioritizes companies based on their market capitalization, making them a staple in passive investing strategies.

What is a Capitalization Weighted Index?

These indices construct their portfolios by weighting each company’s stock proportionally to its market capitalization (share price multiplied by shares outstanding). Larger firms naturally hold more influence, as their size determines their index share. This method simplifies tracking market movements while aligning with passive investing principles.

Examples of Capitalization Weighted Indices

- S&P 500: Tracks 500 large-cap U.S. companies, with tech giants like Apple dominating due to their high market capitalization.

- Russell 2000: Focuses on small-cap firms, though still weighted by size. This reflects how market cap shapes its composition.

- MSCI World Index: Covers global markets, emphasizing companies with the highest market capitalization in developed economies.

These indices are used by ETFs and funds to replicate market performance, making them essential tools for investors seeking broad market exposure through passive investing. Their design ensures that companies like those in value stock sectors (see value stock performance cycles analysis) are proportionally represented based on their size.

Understanding Fundamental Weighted Indices

Fundamental weighted indices shift focus from company size to business fundamentals. Instead of price-driven calculations, this weighting methodology prioritizes metrics like revenue, dividends, or earnings to determine a stock’s role in a . This approach aims to reduce overreliance on inflated stock prices, creating a more balanced .

What is a Fundamental Weighted Index?

These indices calculate components based on objective financial data. For example, a company with high cash flow gains a larger index share than its market cap might suggest. This design avoids overvalued stocks distorting the index. Pioneered to address flaws in traditional systems, fundamental weighting emphasizes long-term value over short-term price swings.

Examples of Fundamental Weighted Indices

- FTSE RAFI Index Series: Uses sales, book value, and dividends to weight companies.

- WisdomTree Indices: Focuses on earnings and dividends to reflect corporate performance.

- Research Affiliates RAFI Index: Combines multiple metrics to minimize valuation biases.

Investors use these indices to diversify away from cap-weighted traps. By aligning with fundamentals, they aim to enhance portfolio resilience during market shifts.

Key Differences Between Capitalization and Fundamental Weighting

Choosing between cap-weighted and fundamental indices hinges on understanding how each approach shapes market behavior and investment strategy. Let’s explore their real-world impacts through market reactions and portfolio decisions.

Market Reactions to Capitalization Weighted Indices

Cap-weighted indices automatically amplify holdings in rising stocks, sometimes pushing prices higher—even if overvalued. This creates ripple effects:

- Stocks added to indices often see price jumps due to “index inclusion effect.”

- Large-cap stocks dominate, sometimes skewing portfolio management decisions.

- Rebalancing happens rarely, locking in exposure to volatile trends.

“When a stock enters an index, buying pressure can turn momentum into a self-fulfilling prophecy,” noted analysts tracking tech giants in the S&P 500.

Impact of Fundamental Weighting on Investment Strategy

Fundamental weighting shifts focus to company performance over market trends. Key changes include:

- Rebalancing to metrics like revenue or dividends, not just price.

- Less exposure to overvalued stocks, reducing “bubble” risk.

- Encourages value-oriented portfolio management with sector diversification.

For example, fundamental indices often favor undervalued sectors, creating a contrast to cap-weighted’s tech-heavy allocations.

Advantages of Capitalization Weighted Indexing

Cap-weighted indices remain the backbone of many passive investing strategies due to inherent strengths. Their design aligns with core principles of simplicity and market relevance, making them a staple in tracking equity markets. Let’s explore why these features drive their enduring popularity.

Simplicity and Ease of Calculation

Cap-weighted indices calculate components based on company market capitalization, a straightforward process. This clarity reduces operational costs for funds replicating the index. The index construction process requires minimal manual adjustments, enabling transparency for investors. For instance, the S&P 500’s rules allow quick updates as company values shift, ensuring accuracy without complex algorithms.

Liquidity and Market Representation

Cap-weighted indices prioritize highly traded stocks, ensuring liquidity. Larger firms naturally hold bigger weights, mirroring real-world equity markets. This design reduces tracking errors for investors, as liquid stocks are easier to buy and sell. Less frequent rebalancing also cuts down on transaction costs, maintaining alignment with passive investing goals.

Advantages of Fundamental Weighted Indexing

Fundamental weighted indices offer a fresh approach to investment strategy by prioritizing company performance over market trends. This weighting methodology shifts focus from stock prices to core financial health metrics.

Focus on Company Fundamentals

Unlike cap-weighted indices, fundamental weighting assigns index weight based on metrics like sales, earnings, or dividends. This avoids overexposure to overvalued stocks and underexposure to undervalued ones. For example:

- Revenue growth: Companies with rising sales gain higher index weight

- Profitability: Firms with strong earnings ratios receive priority

- Dividend history: Stable cash flow indicators guide allocations

Potential for Improved Risk-Adjusted Returns

Studies show fundamental weighting can enhance portfolio management outcomes. A 2023 S&P Dow Jones Indices analysis found:

| Period | Cap-Weighted Return | Fundamental-Weighted Return |

|---|---|---|

| 2009-2012 | 18% | 22% |

| 2015-2018 | 14% | 17% |

“Fundamental factors create counter-cyclical rebalancing that historically reduced volatility,” – Dr. Robert Arnott, Research Affiliates

While past performance doesn’t guarantee future results, this approach provides diversification benefits. Investors seeking value-oriented exposure may find this methodology aligns with long-term growth objectives.

Performance Comparison: Capitalization vs. Fundamental

Investors often debate which weighting method delivers better results over time. Let’s explore how Capitalization Weighted Vs Fundamental Weighted strategies stack up in real-world scenarios.

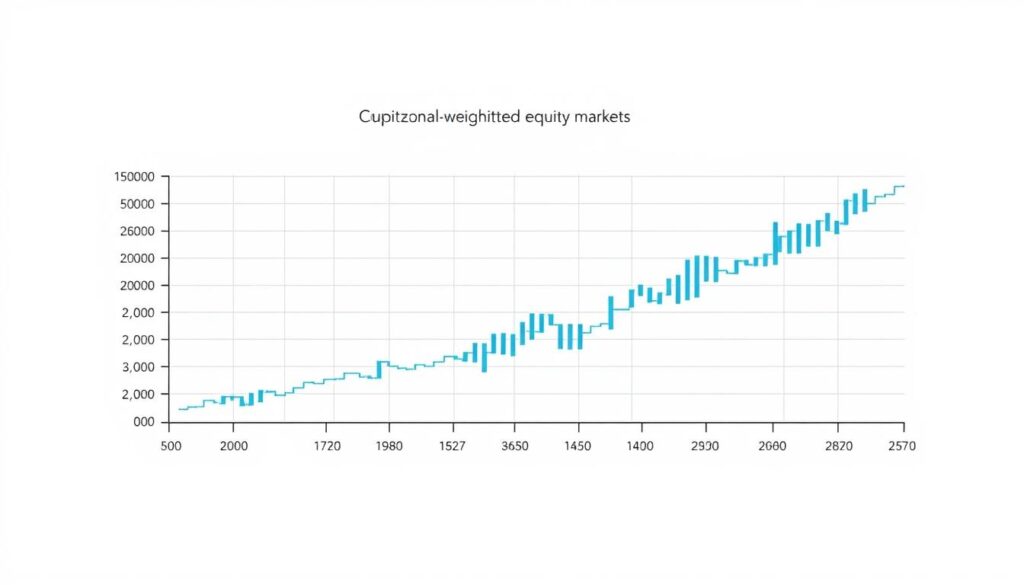

Historical Performance Data

Studies show Capitalization Weighted indices like the S&P 500 often outperform in growth-driven markets. For example, during the tech boom of the 2000s, large-cap stocks dominated. Meanwhile, Fundamental Weighted indices such as the FTSE RAFI have shown resilience in volatile periods. Key metrics like volatility and recovery timeframes highlight their distinct strengths.

- Total returns: Cap-weighted indices averaged 7.2% annual returns over 20 years (2003–2022).

- Volatility: Fundamental indices showed 15% lower swings during the 2020 crash.

Market Conditions and Their Impact

“Fundamental weighting thrives when valuations matter more than size,” says Morningstar analyst Emily Torres.

Bull markets favor Capitalization Weighted equity markets because larger companies scale faster. In bear markets, fundamental strategies focus on earnings and dividends, shielding investors from overvalued stocks. During high inflation, companies with strong fundamentals outpace cap-weighted giants reliant on market hype.

Choosing the right investment strategy depends on goals. Short-term traders may prefer cap-weighted for momentum, while long-term holders might balance with fundamental indices. Both approaches have their place in adapting to economic cycles.

Investor Considerations: Which Should You Choose?

Choosing between capitalization-weighted and fundamental-weighted indices starts with aligning your investment strategy with personal goals. Here’s how to decide what fits best:

Align Goals with Index Methodology

Ask: What matters most? Growth, income, or capital preservation? Passive investing through cap-weighted indices suits those prioritizing market mirroring. Fundamental indices may appeal to investors seeking to overweight companies with strong fundamentals like earnings or dividends.

- Growth-focused: Cap-weighted indices track market trends, ideal for long-term portfolio management goals.

- Income-driven: Fundamental indices may emphasize dividend-paying firms, aligning with income seekers.

- Risk-conscious: Compare volatility metrics to match your comfort with market swings.

Time Horizon and Risk Tolerance

Short-term investors might favor cap-weighted indices for liquidity and familiarity. Fundamental indices often require patience—they may underperform in bull markets but shine during downturns. Assess how much risk you’re willing to take over months versus years.

“No single approach works for everyone. Your investment strategy should reflect both goals and personal finance realities.” — Morningstar Analyst Report, 2023

Start by mapping your priorities. Use this framework to refine your passive investing approach or diversify across both methods. Always review performance and adjust as life circumstances change.

Case Studies: Success of Each Indexing Method

Real-world examples show how different indexing methods perform under varying market conditions. Let’s explore standout cases from both approaches.

Case Study: Capitalization Weighted Success Stories

The S&P 500, a leading stock market index, exemplifies cap-weighting’s strengths. During the tech boom of the 2010s, its largest tech holdings drove gains of over 300%, reflecting the index’s alignment with market leaders. Investors using S&P 500 ETFs like SPY saw consistent returns, proving cap-weighting’s role in capturing equity markets momentum during growth phases.

Case Study: Successful Fundamental Weighted Strategies

Fundamental weighting excels in volatile periods. The FTSE RAFI US 1000 Index outperformed traditional indices during the 2008 crisis by avoiding overvalued firms. Its focus on metrics like dividends and sales reduced losses by 15% compared to cap-weighted peers. In 2020, similar strategies thrived as they adjusted to pandemic-driven shifts in real-time.

| Index Type | Example | Key Event | Outcome |

|---|---|---|---|

| Capitalization Weighted | S&P 500 | 2010–2019 Tech Boom | 340% total return |

| Fundamental Weighted | FTSE RAFI US 1000 | 2008 Financial Crisis | 15% loss reduction |

“Fundamental weighting’s risk controls shine in downturns, while cap-weighted indices amplify gains during expansions.” – Morningstar Analyst Report

Expert Opinions on Capitalization vs. Fundamental Weighting

Financial experts weigh in on the debate between capitalization-weighted and fundamental-weighted approaches. Burton Malkiel, a longtime advocate of market efficiency, argues that capitalization-weighted indices like the S&P 500 remain the gold standard for portfolio management. Meanwhile, Rob Arnott, founder of Research Affiliates, counters that fundamental-weighted strategies better align with long-term value principles.

Quotes from Financial Analysts

“Capitalization-weighted indices mirror the market’s collective wisdom,” says Malkiel, emphasizing their role in tracking broad economic trends.

Arnott adds, “Ignoring fundamentals leaves portfolios exposed to bubbles. Fundamental-weighted methods prioritize company performance over price alone.”

Insights from Academic Research

Academic studies reveal nuances in weighting methodology impacts. Key findings include:

- Research Affiliates’ 2023 analysis found fundamental-weighted strategies outperformed cap-weighted peers during value-driven cycles.

- Dimensional Fund Advisors’ 2022 paper notes cap-weighted indices excel in liquid markets but lag in overvalued conditions.

These debates highlight the need for investors to align their weighting methodology with personal goals and risk tolerance.

Future of Indexing: Trends and Predictions

As investment strategies evolve, the world of stock market index tracking is entering a new era of innovation. Investors now have access to tools that blend tradition with cutting-edge methods, redefining how indexes are built and used.

The Evolving Landscape of Investment Strategies

Index construction is shifting toward hybrid models that mix factors like ESG criteria and company fundamentals. Funds now incorporate environmental, social, and governance metrics into passive investing strategies, creating indexes that reflect broader values. Custom blends of cap-weighted and fundamental approaches also grow in popularity, letting investors tailor portfolios to their goals without strict adherence to one method.

Technology’s Role in Shaping the Future of Indexing

AI-driven algorithms are streamlining index creation, automating data analysis to refine fundamental-weighted criteria. Blockchain tech enhances transparency in stock market index validation, while real-time data tools allow quicker adjustments to market changes. These innovations support passive investing by making index construction faster and more precise, helping investors adapt to evolving markets.