Traders often rely on various technical indicators to make informed decisions. One such valuable tool is the Anchored Volume-Weighted Average Price (VWAP), a variation of the traditional VWAP indicator. By anchoring VWAP to a specific point in time, traders can gain insights into market trends and sentiment.

Anchored VWAP allows traders to reset the VWAP calculation at a specific event or time, providing a more nuanced view of market activity. This can be particularly useful for analyzing the impact of significant news events or market movements.

Key Takeaways

- Anchored VWAP is a variation of the traditional VWAP indicator.

- It allows traders to anchor the VWAP calculation to a specific point in time.

- This provides a more nuanced view of market trends and sentiment.

- Useful for analyzing the impact of significant news events or market movements.

- Helps traders make more informed decisions.

Understanding VWAP and Its Importance

In the realm of trading, VWAP stands out as a vital indicator that combines price and volume to give a clearer picture of market dynamics. Understanding VWAP is crucial for traders and investors alike, as it provides valuable insights into market trends and helps in making informed trading decisions.

What is VWAP?

VWAP, or Volume Weighted Average Price, is a trading indicator that calculates the average price of a security over a specific period, weighted by volume. It’s calculated by adding up the dollars traded for every transaction (price multiplied by the number of shares traded) and then dividing by the total shares traded. This gives a more accurate picture of the security’s price action compared to a simple average price.

Why is VWAP Used in Trading?

VWAP is used by traders for several reasons. Firstly, it serves as a benchmark for evaluating trading performance. If a trader buys a stock below the VWAP, it’s considered a good execution. Conversely, selling above the VWAP is seen as a positive trade. VWAP also helps in identifying trends and potential trading opportunities. For instance, if the current price is above VWAP, it may indicate an uptrend, and if it’s below VWAP, it could signal a downtrend.

Key Benefits of VWAP

The key benefits of using VWAP include:

- Accurate Market Representation: VWAP provides a more accurate representation of the market by considering both price and volume.

- Trading Performance Evaluation: It serves as a benchmark to evaluate the quality of trade executions.

- Trend Identification: VWAP helps in identifying market trends, aiding traders in making informed decisions.

Understanding VWAP and its importance lays the groundwork for exploring more advanced trading indicators like Anchored VWAP. By grasping the basics of VWAP, traders can better appreciate the nuances of Anchored VWAP and its applications in trading strategies.

The Concept of Anchored VWAP

The Anchored VWAP is a refined trading indicator that offers a more nuanced view of market trends. It allows traders to anchor the Volume Weighted Average Price to a specific point in time, providing a more tailored analysis of market movements.

Definition of Anchored VWAP

Anchored VWAP is a variation of the traditional VWAP indicator that is anchored to a specific date or event, rather than being reset at the start of each trading day. This allows traders to analyze the market’s behavior relative to a significant event or period.

How Anchored VWAP Differs from Standard VWAP

The primary difference between Anchored VWAP and standard VWAP is the flexibility to choose the starting point for the VWAP calculation. Unlike standard VWAP, which resets daily, Anchored VWAP can be anchored to any significant event or date, such as earnings announcements, economic releases, or the beginning of a trend. This flexibility makes Anchored VWAP particularly useful for analyzing the impact of specific events on market dynamics.

To further illustrate the differences and applications of Anchored VWAP, let’s consider the following table:

| Feature | Anchored VWAP | Standard VWAP |

|---|---|---|

| Reset Period | Can be anchored to any significant date or event | Resets at the start of each trading day |

| Analysis Flexibility | Offers more flexibility in analyzing market movements relative to specific events | Limited to daily analysis |

| Usefulness in Trading | Particularly useful for event-driven trading strategies | Useful for intraday trading strategies |

By anchoring VWAP to significant events or dates, traders can gain deeper insights into market dynamics and make more informed trading decisions.

How to Calculate Anchored VWAP

To effectively utilize Anchored VWAP, understanding its calculation process is essential.

The Anchored VWAP is a powerful tool that helps traders gauge the market’s sentiment and make informed decisions.

Step-by-Step Calculation Process

The calculation of Anchored VWAP involves a specific formula that takes into account the total traded value and volume from a chosen anchor point onwards.

- Select an Anchor Point: Choose a significant point in time or price level from which to start the calculation.

- Calculate Typical Price: For each period, calculate the typical price as `(High + Low + Close) / 3.

- Calculate Traded Value: Multiply the typical price by the volume for each period.

- Cumulative Traded Value and Volume: Sum up the traded values and volumes from the anchor point onwards.

- Anchored VWAP Calculation: Divide the cumulative traded value by the cumulative volume to get the Anchored VWAP.

Tools for Calculating Anchored VWAP

Several trading platforms and software offer tools to calculate Anchored VWAP, making it easier for traders to apply this indicator in their strategies.

| Tool/Platform | Description | Key Features |

|---|---|---|

| TradingView | A popular charting platform | Offers Anchored VWAP indicator, customizable |

| MetaTrader | A widely used trading platform | Allows for custom indicators, including Anchored VWAP |

| Thinkorswim | A professional trading platform | Provides advanced tools for calculating and applying Anchored VWAP |

By understanding and applying the Anchored VWAP calculation, traders can enhance their trading strategies and gain deeper insights into market dynamics.

Using Anchored VWAP in Trading Strategies

Incorporating Anchored VWAP into trading strategies can lead to more informed decision-making. Anchored VWAP provides a nuanced view of market trends, allowing traders to make more precise entries and exits.

This section will explore how to effectively utilize Anchored VWAP in trading strategies, focusing on key aspects such as identifying entry and exit points and combining it with other technical indicators.

Identifying Entry and Exit Points

Anchored VWAP is particularly useful for identifying optimal entry and exit points. By anchoring the VWAP to a specific date or event, traders can gain insights into how the market is behaving relative to that anchor point.

This can help in understanding whether the current price is above or below the average price since the anchor date, thus indicating potential trading opportunities.

Incorporating Anchored VWAP with Other Indicators

To maximize the effectiveness of Anchored VWAP, traders often combine it with other technical indicators. For instance, using Anchored VWAP in conjunction with moving averages or Relative Strength Index (RSI) can provide a more comprehensive view of the market.

This multi-faceted approach helps in confirming trading signals and reducing the risk of false moves. Traders can also use Anchored VWAP to analyze the strength of trends.

By comparing the Anchored VWAP with the standard VWAP, traders can gauge the market’s sentiment since the anchor date. Furthermore, Anchored VWAP can be used to set stop-loss levels or to confirm breakouts.

Examples of Anchored VWAP in Action

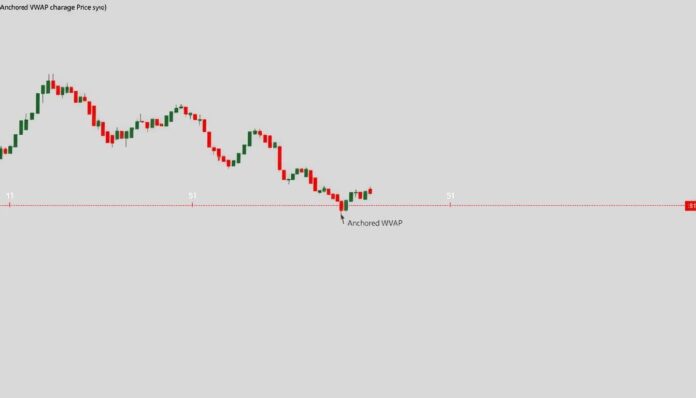

To understand the effectiveness of Anchored VWAP, it’s essential to examine its application in real-world trading scenarios. By doing so, traders can gain valuable insights into how this indicator can be used to inform trading decisions.

The Anchored VWAP indicator is particularly useful for identifying trends and potential entry and exit points. Its ability to provide a nuanced view of market activity makes it a valuable tool for traders looking to refine their strategies.

Real-World Trading Scenarios

In real-world trading scenarios, Anchored VWAP is used to analyze the behavior of stocks or other financial instruments over specific periods. For instance, a trader might use Anchored VWAP to understand the trend of a stock from a significant event, such as an earnings report.

- Identifying support and resistance levels

- Confirming trend directions

- Informing entry and exit strategies

By applying Anchored VWAP to these scenarios, traders can make more informed decisions, potentially leading to more successful trades.

Case Studies of Successful Trades

Several case studies illustrate the successful application of Anchored VWAP in trading. For example, a trader might use Anchored VWAP to identify a support level in a downtrend, providing a potential buying opportunity.

- A trader identifies a stock that has pulled back to its Anchored VWAP during a downtrend, recognizing this as a potential support level.

- Another trader uses Anchored VWAP to confirm the strength of a trend, entering a long position as the stock price bounces off the Anchored VWAP line.

These case studies demonstrate how Anchored VWAP can be effectively used in various trading strategies, enhancing the trader’s ability to navigate the markets.

The key to successfully using Anchored VWAP lies in understanding its implications and integrating it into a comprehensive trading strategy.

Common Mistakes When Using Anchored VWAP

Traders often encounter pitfalls when utilizing the anchored vwap indicator in their trading strategies. Understanding these common mistakes is crucial to maximizing the benefits of this powerful tool.

Data Misinterpretation

One of the primary errors traders make is misinterpreting the data provided by the anchored vwap indicator. It’s essential to comprehend what the indicator signifies and how it relates to market trends.

Overreliance on the Indicator

Relying too heavily on the anchored vwap indicator can lead to missed opportunities. Traders should combine it with other indicators to form a comprehensive trading strategy.

Practical Tips for Traders

To avoid common mistakes, traders should stay informed about market conditions and continually update their knowledge of the anchored vwap indicator. By doing so, they can effectively use the indicator to identify profitable trades and minimize losses. Understanding what is anchored vwap and its applications is key to successful trading.

A writer, editor, and publisher with a knack for crafting informative articles.