Exchange-Traded Funds (ETFs) have become a popular investment vehicle for both new and experienced investors. Fidelity, one of the largest brokerage firms in the U.S., provides a seamless way to invest in ETFs through its user-friendly platform. Below, we provide a step-by-step guide on how to buy an ETF on Fidelity, ensuring that you can make informed investment decisions efficiently.

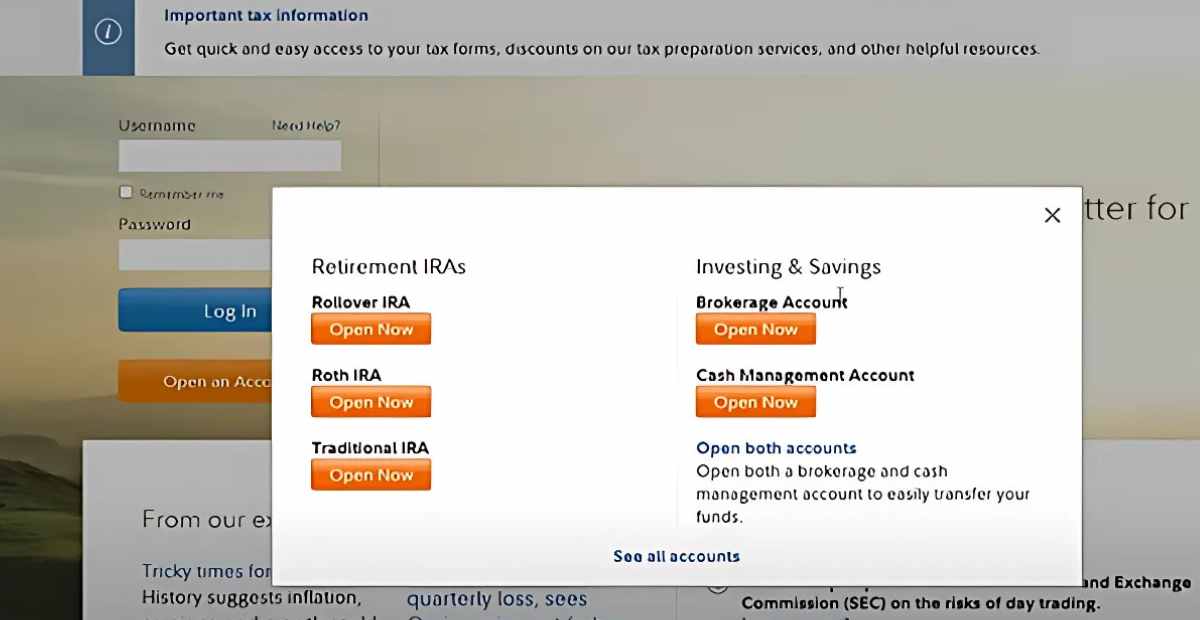

Step 1: Open and Fund a Fidelity Brokerage Account

Before purchasing ETFs, you need a Fidelity brokerage account. If you do not have one, follow these steps:

- Visit Fidelity’s Website – Go to Fidelity’s official website and click on “Open an Account.”

- Choose the Right Account Type – Fidelity offers multiple account types, including Individual, Joint, IRA, and Trust accounts. Choose the one that suits your investment goals.

- Provide Personal Information – Fill out your details, including name, address, Social Security Number (SSN), and employment information.

- Agree to Terms and Conditions – Review Fidelity’s agreements and disclosures.

- Fund Your Account – Transfer funds using a bank transfer, check deposit, or wire transfer to ensure you have capital available for trading.

Step 2: Research ETFs on Fidelity

Fidelity offers a wide range of ETFs, including commission-free Fidelity ETFs, iShares ETFs, and other third-party ETFs. To find the best ETF:

- Use Fidelity’s ETF Screener – Fidelity provides a robust ETF screening tool to help investors filter ETFs based on factors such as expense ratio, performance, sector, and market capitalization.

- Analyze Key Metrics – Look at essential details such as:

- Expense Ratio – Lower expense ratios mean lower costs.

- Historical Performance – Past performance can help gauge potential future returns.

- Holdings and Sectors – Review what assets the ETF holds.

- Liquidity and Volume – Higher liquidity ensures smoother trade execution.

Step 3: Place an ETF Order on Fidelity

Once you have selected an ETF, follow these steps to place an order:

- Log In to Your Fidelity Account – Use your credentials to sign in.

- Navigate to the “Trade” Section – Click on “Trade” in the top menu.

- Enter the ETF Ticker Symbol – Type the symbol of the ETF you want to purchase. Example: SPY for the S&P 500 ETF.

- Select Order Type – Choose from different order types:

- Market Order – Executes at the current market price.

- Limit Order – Executes only at your specified price.

- Stop Order – Executes when the ETF reaches a specific price.

- Choose Quantity – Decide how many shares or the dollar amount you wish to invest.

- Review and Confirm – Double-check order details and confirm the trade.

Step 4: Monitor Your ETF Investment

After purchasing an ETF, it is crucial to track your investment:

- Check Performance – Use Fidelity’s portfolio tracking tools to analyze ETF performance.

- Set Alerts – Fidelity allows users to set price alerts and notifications.

- Rebalance Portfolio – Periodically assess your portfolio to align with investment goals.

- Dividend Reinvestment – Many ETFs offer dividend reinvestment plans (DRIP), allowing you to reinvest dividends automatically.

Step 5: Manage ETF Investments Efficiently

To ensure optimal returns, consider these strategies:

- Diversify Your Holdings – Avoid putting all your money into a single ETF; instead, spread investments across various sectors.

- Utilize Dollar-Cost Averaging (DCA) – Invest a fixed amount regularly to minimize the impact of market fluctuations.

- Keep an Eye on Fees – While many ETFs are commission-free, be aware of management fees and transaction costs.

- Understand Tax Implications – Some ETFs may trigger capital gains taxes; Fidelity provides tax-efficient investment options.

Why Choose Fidelity for ETF Investing?

Fidelity stands out as a top brokerage for ETF investing due to its low costs, advanced trading tools, and educational resources. Key benefits include:

- Zero Commission on Fidelity ETFs – No trading fees for in-house ETFs.

- Comprehensive Research Tools – Access to Morningstar ratings, analyst reports, and real-time market data.

- User-Friendly Mobile App – Trade ETFs on the go with the Fidelity mobile application.

- Customer Support – 24/7 customer assistance and live chat support.

Common Questions About Buying ETFs on Fidelity

-

Can I Buy Fractional Shares of ETFs on Fidelity?

Yes, Fidelity offers fractional share trading, allowing investors to buy portions of an ETF with as little as $1.

-

How Long Does It Take for an ETF Order to Execute?

Market orders execute instantly during trading hours. Limit and stop orders execute when conditions are met.

-

Are Fidelity ETFs a Good Investment?

Fidelity ETFs offer low expense ratios, strong performance history, and no commission fees, making them an attractive choice for investors.

-

Can I Sell an ETF Anytime?

Yes, ETFs are highly liquid assets, and you can sell them at any time during market hours.

-

What Is the Minimum Amount Needed to Buy an ETF?

There is no minimum investment amount for most ETFs on Fidelity. However, some ETFs may require a minimum if purchased through a mutual fund alternative.

Final Thoughts

Buying ETFs on Fidelity is a straightforward process that offers diversification, cost efficiency, and ease of trading. By following the steps outlined above, investors can confidently navigate the platform, research ETFs, and execute trades seamlessly. Whether you are a beginner or an experienced investor, Fidelity provides the tools and resources to help you succeed in ETF investing.

A writer, editor, and publisher with a knack for crafting informative articles.