Investors often wonder if market capitalization directly influences stock prices or if it’s simply a result of them. This article explores the market capitalization impact on stock price, addressing whether changes in market cap drive price movements or reflect broader trends. For new and seasoned traders, understanding this link clarifies how company size and investor sentiment shape market dynamics.

Key Takeaways

- Market cap and stock prices share a two-way relationship.

- Market cap reflects company size but also reacts to price shifts.

- Investors use both metrics to assess risk and growth potential.

- Misconceptions about their connection can lead to flawed decisions.

- This guide breaks down how they interact in real-world scenarios.

Understanding Market Capitalization

At its core, market cap simplifies complex company valuations into a single number. This metric acts as a compass for investors navigating the stock market’s vast landscape.

Definition of Market Cap

Market capitalization is calculated by multiplying a company’s outstanding shares by its current stock price. For example, if Apple has 10 billion shares trading at $200 each, its market cap is $2 trillion. This number reflects investor sentiment about a company’s future potential, not just past performance.

- Formula: Shares Outstanding × Current Stock Price = Market Cap

- Example: A company with 50 million shares at $50 per share has a $2.5 billion market cap.

Importance of Market Cap in Investing

Investors use market cap to gauge risk and opportunity. Smaller companies often have higher growth potential but more volatility, while larger firms tend to offer stability. According to a study on value stock performance, market cap helps identify undervalued stocks during economic shifts like rising interest rates.

| Key Factor | Influence on Decisions |

|---|---|

| Market cap tiers | Guide investment strategies |

| Stock price trends | Highlight growth or decline |

Understanding this market capitalization and stock price connection helps investors align their portfolios with goals like correlation between market cap and stock value. Whether tracking tech giants or emerging firms, market cap remains a foundational tool for informed decisions.

How Market Cap Influences Stock Prices

Understanding the influence of market cap on stock price reveals how investor behavior and market forces shape financial outcomes. Companies’ stock prices and their total market value often move in tandem, creating a dynamic relationship between market cap and stock price movement. This interplay affects everything from trading volumes to investment decisions.

The Relationship Between Market Cap and Stock Value

When a company’s stock price rises, its market cap grows. But this isn’t a one-way street. Large-cap firms like Apple or Amazon often stabilize prices due to investor confidence in their established valuations. Smaller companies, however, see sharper swings. For instance, a biotech startup’s stock might spike after a drug approval, boosting its market cap and signaling growth potential.

Examples of Market Cap Impacting Prices

- Tesla’s $1 trillion milestone: In 2022, Tesla’s stock surged past $300 billion to $1 trillion, driven by high investor optimism, which further amplified its market cap.

- S&P 500 inclusion: When NVIDIA joined the S&P 500 in 2019, its stock price jumped 15% in a week due to increased institutional buying.

- Small-cap volatility: GameStop’s 2021 rally saw its market cap jump from $2 billion to $24 billion, showing how sudden price jumps redefine company valuation.

These cases highlight how market cap isn’t just a number—it’s a signal. Investors watch thresholds like $10 billion or $1 trillion because crossing them often triggers buying or selling waves, directly impacting stock prices. Recognizing this loop helps traders anticipate shifts in market dynamics.

Types of Market Capitalization

Market cap vs stock price analysis starts with categorizing companies by size. These groupings—small-cap, mid-cap, and large-cap—shape how their stock prices move. Each bracket’s risk and growth profile offers clues for investors.

| Type | Market Cap | Stock Price Behavior | Example |

|---|---|---|---|

| Small-Cap | <$2B | Sharp swings due to news | Tilray Bioscience |

| Mid-Cap | $2B–$10B | Stable yet opportunistic | Dollar Tree |

| Large-Cap | >$10B | Slow but steady changes | Apple, Microsoft |

Small-Cap Stocks

Companies under $2 billion often face market cap’s effect on stock price swings. Their smaller size means stock prices jump or drop on breakthroughs or setbacks. These firms can outperform but carry higher risk.

Mid-Cap Stocks

Mid-range companies ($2B–$10B) balance growth and stability. Their stock prices reflect both industry trends and company-specific news. Investors call these “sweet spots” for diversification.

Large-Cap Stocks

Large-caps over $10 billion dominate industries. Their stock prices shift gradually, reacting to macroeconomic shifts rather than daily news. These stocks often pay dividends, prioritizing income over rapid gains.

Market Cap vs. Other Factors Influencing Stock Prices

While the significance of market cap in influencing stock price is clear, other forces often take center stage. Let’s explore how earnings, economic trends, and investor emotions compete with market cap in shaping stock values.

Earnings reports act as a wildcard. Take Netflix: a small-cap streaming startup with explosive quarterly growth could outperform giants if revenue surprises analysts. As Warren Buffett once said,

“Numbers in earnings reports are the clearest signals investors have.”

Even large-cap stalwarts like Coca-Cola see prices swing wildly when sales miss targets.

- Earnings Reports: Quarterly results often override market cap rankings. Tesla’s $600B+ market cap took a hit when 2023 deliveries fell short of expectations.

- Economic Indicators: The Federal Reserve’s rate hikes in 2022 caused tech stocks to drop, proving interest rates affect all caps. Small-caps usually suffer first in recessions.

- Market Sentiment: Social media buzz can inflate prices despite low market caps. GameStop’s 2021 surge showed how Reddit chatter defied traditional valuations.

Though the market capitalization impact on stock price remains foundational, these variables constantly shift priority. Investors must balance cap size with earnings surprises, rate changes, and viral news cycles to make smart decisions.

Why Investors Care About Market Cap

Investors track market cap’s influence on stock valuation to align their goals with risk and reward. This metric shapes decisions from portfolio diversification to long-term growth targets.

Risk Assessment

- Small-cap stocks often carry higher volatility but potential for rapid growth.

- Large-cap firms tend to offer stability, making them safer for conservative investors.

Professional advisors use market cap to match client risk profiles. For instance, retirement portfolios might favor large-cap stalwarts like Apple or Microsoft for steady returns.

Investment Strategy Development

Strategies like Does Market Cap Affect Stock Price analysis guide sector allocations. Growth investors target high-potential small caps, while value strategies focus on undervalued large caps.

“Market cap isn’t just a number—it’s a roadmap for building resilient portfolios.” – Financial Times, 2023 Equity Trends Report

By analyzing market cap’s influence on stock valuation, investors avoid overexposure to volatile sectors. Tools like sector rotation models now incorporate real-time market cap data for dynamic adjustments.

Market Trends and Their Impact on Market Cap

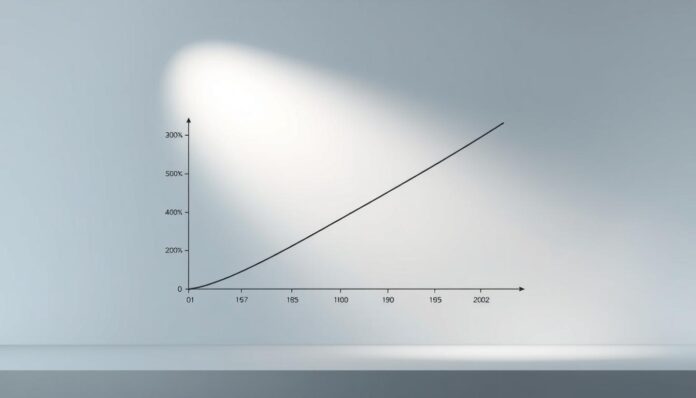

Market trends shape the correlation between market cap and stock value and the influence of market cap on stock price. Let’s explore how sectors and economic cycles drive these connections.

Sector Performance

Technology and healthcare stocks often see stronger market cap-to-price ties during innovation booms. For example, Apple’s rising market cap during iPhone launches shows how sector trends amplify stock value. Meanwhile, utilities stocks may see flatter correlations due to stable but slower growth.

| Sector | Market Cap Impact | Example |

|---|---|---|

| Technology | High volatility | Amazon’s cloud services |

| Healthcare | Driven by R&D | Pfizer vaccine demand |

| Utilities | Stable but narrow | NextEra Energy |

Economic Cycles

Economic phases alter how market cap affects stock prices. Here’s how:

- Expansion: Small-caps surge as demand grows.

- Peak: Large-caps stabilize while small-caps may overheat.

- Contraction: Defensive stocks like consumer staples retain value.

- Trough: Bargain hunters target beaten-down large-caps.

During the 2020 recession, small-cap energy stocks dropped 30% while tech giants like Microsoft held strong, showing cycle-specific patterns.

Market Capitalization and Company Performance

Market capitalization and stock price connection hinges on a company’s performance. Strong growth can boost market cap, driving stock prices higher. Conversely, stagnant performance may shrink market value, impacting investor sentiment. This relationship between market cap and stock price movement creates a feedback loop shaping investment outcomes.

Correlation with Growth Potential

Companies like Tesla and Amazon illustrate how growth fuels market cap expansion. Startups scaling into mid-cap status often see stock price jumps due to investor optimism. Growth metrics like revenue and innovation directly tie to market cap shifts. For example, a biotech firm achieving FDA approval might see its market cap surge, pushing stock prices upward.

Market Perception

Perception matters. Large-cap firms attract more analyst coverage, making their stock prices reflect real-time data. Smaller companies with less visibility may face price swings due to speculation.

“Market perception turns whispers into trends,”

notesJane Smith, equity analyst at XYZ Research. High-profile firms benefit from institutional interest, while smaller firms rely on niche investor attention. This dynamic affects how market cap changes translate into stock price movements.

Why Market Cap Shouldn’t Be the Sole Focus

While market cap plays a role in shaping stock price movements, investors must avoid treating it as the only lens for analysis. Market cap vs stock price analysis requires balancing this metric with other data points to make informed decisions.

The Importance of Comprehensive Analysis

Looking only at market cap ignores critical details like profit margins, debt levels, and industry competition. For instance, a small-cap company with strong earnings growth might outperform a large-cap firm in decline. Investors should pair market cap’s effect on stock price with metrics such as P/E ratios, cash flow, and management track records. This holistic view prevents overvaluing companies based on size alone.

Holistic Investment Strategies

Smart strategies blend market cap analysis with broader market trends and individual goals. Conservative investors might prioritize stable large-caps with consistent dividends, while growth-oriented traders could explore smaller caps with high innovation potential. Tools like SWOT analysis or peer comparisons help contextualize market cap within the bigger financial picture.

Ultimately, market cap influences stock prices but isn’t destiny. The best investors use it as one piece of evidence in a larger evaluation process. By combining market cap insights with fundamental and technical analysis, you build a strategy that adapts to market realities without blind spots.

A writer, editor, and publisher with a knack for crafting informative articles.