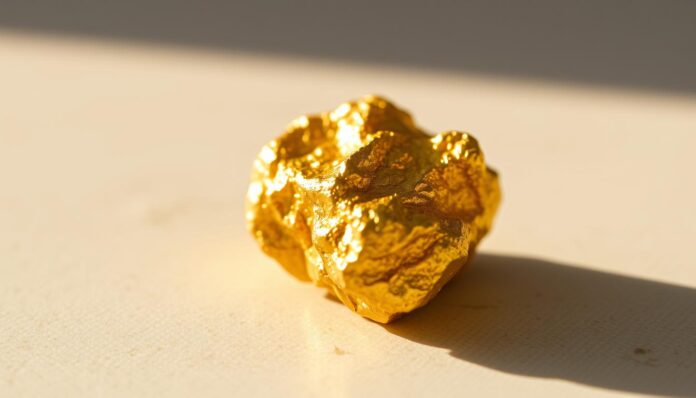

For centuries, gold has been a symbol of wealth and a store of value, but its worth is not as straightforward as it seems. The debate surrounding its intrinsic value has been ongoing.

The concept of intrinsic value refers to the inherent worth of an asset, independent of external factors. In the case of gold, its value is influenced by a combination of historical, economic, and cultural factors.

Understanding whether gold has intrinsic value requires exploring its history and the various elements that contribute to its perceived worth.

Key Takeaways

- The concept of intrinsic value is crucial in understanding the worth of assets like gold.

- Gold’s value is influenced by historical, economic, and cultural factors.

- The debate around gold’s intrinsic value is complex and multifaceted.

- Understanding gold’s intrinsic value requires a nuanced approach.

- Gold has been a symbol of wealth for centuries, but its value is not straightforward.

Understanding Intrinsic Value

To assess whether gold has intrinsic value, we must first define what intrinsic value is. Intrinsic value refers to the inherent worth of an asset that is not derived from external factors such as market trends or investor perceptions.

Definition of Intrinsic Value

Intrinsic value is a concept used across various financial and investment contexts. It signifies the true value of an asset based on its inherent characteristics rather than its market price. For an asset like gold, intrinsic value could be linked to its rarity, its aesthetic and industrial applications, and its historical significance.

Why Is It Important?

Understanding the intrinsic value of gold is crucial for investors, economists, and anyone interested in the precious metals market. It helps in making informed decisions about investments and in understanding the role gold plays in the global economy.

| Characteristic | Description | Impact on Intrinsic Value |

|---|---|---|

| Rarity | Gold is a rare metal, difficult to mine and extract. | High rarity contributes to high intrinsic value. |

| Industrial Use | Gold has various industrial applications due to its conductivity and ductility. | Practical uses add to its value. |

| Aesthetic Appeal | Gold is valued for its beauty and used extensively in jewelry. | Aesthetic appeal increases demand and thus intrinsic value. |

| Historical Significance | Gold has been a symbol of wealth and power throughout history. | Historical significance adds to its perceived and intrinsic value. |

The Historical Significance of Gold

Gold has been a cornerstone of human civilization, serving not only as a form of currency but also as a symbol of wealth and power. Its impact on human history is multifaceted, influencing economies, cultures, and individual lives in profound ways.

For centuries, gold has been used in various forms, from coins to jewelry, and its value has been recognized across different cultures. The use of gold as a form of currency and store of value has been a common thread throughout history, providing a stable store of value during times of economic uncertainty.

Gold as Currency

Gold’s role as a currency has been significant, with many economies having used it to back their currencies at some point. The gold standard, which linked the value of a currency to the value of gold, was widely used until the mid-20th century. Investors often turn to gold as an investment during times of financial instability, highlighting its perceived value and reliability.

Cultural Symbolism

Beyond its economic uses, gold has also held significant cultural and symbolic value. In many societies, gold is associated with wealth, status, and power. It is used in various cultural and religious rituals, and its possession is often seen as a sign of prosperity and success. The cultural significance of gold is a testament to its enduring appeal and value.

Gold’s Characteristics That Contribute to Value

The characteristics of gold, including its rarity and durability, play a significant role in its valuation. Gold’s value is not solely derived from its aesthetic appeal or its use in jewelry and coins; its intrinsic properties significantly contribute to its worth.

Rarity and Scarcity

Gold is a rare metal, and its scarcity is a fundamental factor in its value. The process of gold mining is complex and challenging, involving extensive exploration and extraction efforts.

The scarcity of gold is due to its limited availability in the Earth’s crust. This scarcity contributes to its high value, as the difficulty in extracting gold makes it a precious commodity.

Chemical Properties

Gold is known for its chemical stability and resistance to corrosion. Unlike many other metals, gold does not react with air, water, or most chemicals, making it highly durable.

This durability is crucial for its value, as it ensures that gold retains its properties over time, making it a reliable store of value.

| Metal | Rarity | Corrosion Resistance | Market Demand |

|---|---|---|---|

| Gold | High | Excellent | High |

| Silver | Moderate | Good | Moderate |

| Platinum | High | Excellent | High |

Investing in gold is often seen as a safe-haven strategy, given its historical performance and the stability it offers in volatile markets. The characteristics of gold, such as its rarity and chemical properties, significantly influence gold pricing and its appeal to investors.

Comparison with Other Assets

Gold’s value becomes more apparent when compared to other investment vehicles like real estate, stocks, and bonds. Understanding how gold performs in relation to these assets can help investors make more informed decisions.

Gold vs. Real Estate

Gold and real estate are both considered stable stores of value, but they have different characteristics. Real estate can generate rental income and has the potential for long-term appreciation in value. However, it is illiquid and requires significant upfront investment. Gold, on the other hand, is highly liquid and can be easily bought and sold. While it doesn’t generate income, gold is often seen as a hedge against inflation and market volatility.

Key differences:

- Liquidity: Gold is more liquid than real estate.

- Income generation: Real estate can generate rental income, whereas gold does not.

- Market volatility: Gold is often used as a hedge against market downturns.

Gold vs. Stocks and Bonds

Comparing gold to stocks and bonds reveals different investment profiles. Stocks offer potential for high returns but come with higher volatility. Bonds provide regular income with relatively lower risk. Gold, while not generating income like bonds or potentially high returns like stocks, serves as a diversification tool. It tends to perform well during economic uncertainty, making it a valuable component in a diversified portfolio.

Investment characteristics:

- Return potential: Stocks generally offer higher return potential than gold.

- Income: Bonds provide regular income, unlike gold.

- Diversification: Gold can reduce portfolio risk through diversification.

In the context of gold market trends, understanding these comparisons is crucial for investors looking to diversify their portfolios and navigate various market conditions.

Current Market Perspectives on Gold

Gold’s value in the modern market is shaped by various investment trends and expert analyses. As we navigate the complexities of the current economic landscape, understanding the factors that influence gold’s price and its appeal as an investment is crucial.

Investment Trends

The investment landscape for gold is dynamic, with trends shifting based on global economic conditions, geopolitical tensions, and investor sentiment. Recently, there has been a notable increase in gold investment due to its perceived safety and potential for long-term value appreciation.

Some key investment trends include:

- Increased allocation to gold in diversified investment portfolios.

- Growing interest in gold ETFs and other gold investment products.

- Rise in gold mining stocks as investors seek exposure to gold through equities.

Expert Opinions

Experts in the financial industry offer varied perspectives on gold’s future value. Some predict a continued rise in gold prices due to ongoing global uncertainties and inflation concerns. Others suggest that gold’s value may stabilize or fluctuate based on market dynamics and central bank policies.

A notable expert opinion comes from Mark Mobius, who has highlighted the importance of gold as a hedge against inflation and market volatility. According to Mobius, “Gold remains a critical component of a diversified investment portfolio, especially during times of economic uncertainty.”

Conclusion: The Nature of Gold’s Value

The value of gold is a complex and multifaceted concept, influenced by its intrinsic characteristics, historical significance, and market dynamics. As discussed throughout this article, gold’s unique properties and the various factors affecting its value make it a fascinating and valuable asset.

Key Takeaways

Gold’s intrinsic value stems from its rarity, durability, and versatility, making it a highly sought-after commodity. Its historical significance as a currency and cultural symbol further enhances its value. When compared to other assets like real estate, stocks, and bonds, gold’s unique characteristics set it apart as a reliable store of value.

Future Prospects

Looking ahead, the future outlook for gold’s value is shaped by various market and economic factors. As investors continue to seek safe-haven assets, gold’s appeal is likely to endure. Understanding the intrinsic value of gold and its role in investment portfolios can help investors make informed decisions.

By considering the historical context, current market trends, and future prospects, it becomes clear that gold remains a valuable and relevant asset in today’s economy.

A writer, editor, and publisher with a knack for crafting informative articles.